Winning the Right Game How to Disrupt, Defend, and Deliver in a Changing World.

Table of Contents

- Introduction: Ecosystem Disruption: When Boundaries Collapse

- Ch 1: Winning the Wrong Game Means Losing

- Ch 2: Ecosystem Defense Is Collective

- Ch 3: Ecosystem Offense: From Adding Competition to Changing Competition

- Ch 4: Timing Ecosystem Disruption: Too Early Can Be Worse Than Too Late

- Ch 5: The Ego-System Trap

- Ch 6: Mindsets Matter: Establishing Leadership is Different from Exercising Leadership

- Ch 7: Strategic Clarity Is Collective

Introduction

Ecosystem Disruption: When Boundaries Collapse

The basis of competition is changing. Are you prepared? Rivalry is shifting from well-defined industries that deliver clear products and services to broader ecosystems that deliver expansive value propositions: from cars to mobility solutions; from banking to fintech platforms; from pharmacies to health management centers; from production lines to intelligent factories. Industry boundaries are collapsing everywhere you look, and the trend is accelerating.

This book is not yet another wake-up call. Indeed, today’s leaders are already wakeful to the point of insomnia. For many, however, wakefulness has added confusion rather than clarity. Why? Because as competition has spilled beyond traditional boundaries, their strategic challenges no longer fit within their strategic frameworks.

Classic disruption was industry disruption. Modern disruption is ecosystem disruption.

Ecosystem disruption occurs when the introduction of new value propositions impacts competition across industries, erasing boundaries and overturning structure. Traditional rivals pursued the same prize with clear winners and losers; today’s challengers are pursuing different goals and focusing on different metrics as they wage their attacks. Traditional rivals focused on their own execution to gain advantage in cost and quality; today’s challengers assemble new sets of partners to create value in ways no individual firm could hope to deliver.

Ecosystem disruptors are not just adding competition, they are redefining the foundations of competition: they are changing the game. Whether you are attacking new markets, or trying to repel these attacks where you live, you need a new perspective on competition, growth, and leverage. Success is no longer about simply “winning” but about making sure that you are winning the right game.

With this book I make a simple promise: I will show you in detail how to play and win in the new ecosystem landscape. This is not about technology, or vision, or risk-taking, although they clearly play an important role. Rather, it is about a new approach— a new playbook—for strategy when boundaries are shifting and rules are changing. Even if you already have a sense for the right answers, the concepts and language provided here will help you connect the dots of your own intuition and— perhaps more importantly— help you connect the dots for others, making it easier for them to follow your logic and your leadership.

At its heart, ecosystem strategy is about partner alignment. Customer insight and great execution are the necessary but no longer sufficient drivers of success. As delivering your value propositions has become more dependent on collaboration, finding ways to align your partners has moved to center stage. In industries, working with partners meant mastering supply chains and distribution channels—everyone understood their role and position. In ecosystems, the challenge is aligning critical partners whose vision of who-does-what may vary dramatically from your own.

This means that the notion of winning itself must become more nuanced. Winners in industries dominate at the top. Winners in ecosystems can create and capture value from a variety of positions, and choosing where to play is just as important as what, how, and when to play.

So much of what we could comfortably assume in a world of industries is overturned in today’s world of ecosystems. But with a change in perspective, we can see new dimensions on the game board that let us ask new questions and craft new approaches:

- How can you identify the shifts that will disrupt your ecosystem, turn partners into rivals, and undermine your ability to win?

- How can you drive ecosystem disruption to collapse boundaries and upend established competitors?

- How can you stand your ground against ecosystem giants, and even thrive in the face of their attacks?

- What is the unique advantage of established firms in playing the ecosystem game?

- How can you predict the timing of ecosystem disruption—when the window of opportunity will open, and when it will close?

- How can you safeguard your role in an ecosystem and avoid the ego-system trap?

- How must the way you select and develop individual leaders change in the context of ecosystems?

For startups, getting these questions wrong manifests as painful pivots—attempts to reposition themselves in the market, not understanding that the key to success is not a different value proposition but rather a better approach to aligning the partners that will give life to their offer. For large corporations, it manifests as endless pilots—attempts at creating new value that succeed in their test-site demonstrations, but fail in the commercial market when partners refuse to scale on the terms you had envisioned. For all organizations, the pain results in hard work, by good people, that never gains the traction it deserves.

More broadly, we have entered an era that calls for a holistic approach to value creation from organizations. The rise of stakeholder capitalism compels firms to recognize their roles and responsibilities in their communities and society at large. Rising to meet this challenge, and turning this requirement into an opportunity, demands an ecosystem-based approach.

In the chapters that follow, we will develop a new perspective, and a new set of principles, for developing effective ecosystem strategies. Our focus is on how to compete, collaborate, and coexist when opportunities and threats no longer respect traditional rules or boundaries. We will dive into illustrative cases that range from familiar tech firms to stalwart incumbents to nimble startups to draw out the meaning and nuance of these principles. The cases will present the facts of how things unfolded. The frameworks will offer a logic for understanding why they unfolded as they did, and how to consider alternatives when you find yourself facing similar situations.

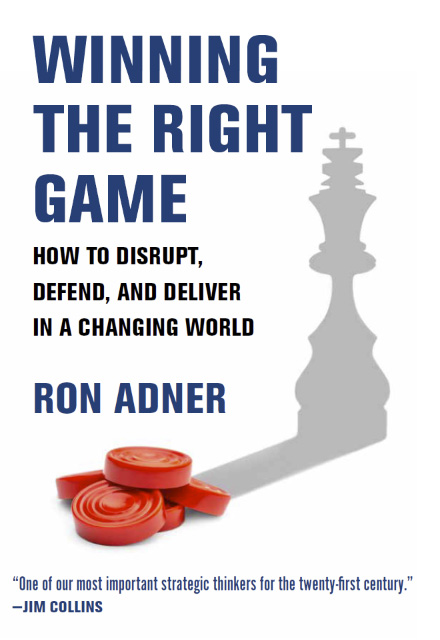

Every case that we explore involves firms that were either born digital or that, as incumbents, had already embraced digital transformation. They all offer lessons—positive and negative—that demonstrate why addressing ecosystem disruption entails not just “becoming digital” but rather mastering what comes next. The plan of the book is summarized in figure I.1. All source material is referenced in the backmatter.

Organizations differ in their specifics. For this reason, answers regarding strategy are rarely right or wrong in a universal sense— a strategy that is great for one organization may be disastrous for another. Strategies very clearly are, however, better or worse in terms of consistency and fit. What matters then, is crafting strategy that suits your firm, and communicating it persuasively enough to drive coherent action across the organization.

The tools and methods in this book offer a language for understanding and articulating strategy in ecosystem settings. They are the combined product of a decade-long journey through research and practice, tested and validated through scores of client engagements ranging from startups to Fortune 100 firms to nonprofit organizations to government entities. They are robust concepts that can become very powerful if you actively apply them to your context. As you progress through the book it is critical to read beyond the cases to actively consider the implications for your own organization: Who are you in the story? Where is your strategy consistent with the principles? Where does it contradict? Where do you feel most and least comfortable with the difference? Most importantly, what must you do to bring your team and your organization along to the same level of understanding?

Everyone is playing to win—the key is to be sure you are trying to win the right game.

Chapter 1

Winning the Wrong Game Means Losing

"What gets us into trouble is not what we don’t know. It’s what we know for sure that just ain’t so." —Mark Twain

It was a funeral for a king. When Kodak, an icon of American innovation, filed for bankruptcy protection in January 2012 the world grieved in sepia tones. Having invented the world’s first digital camera in 1975, the conventional story goes, myopic managers allowed a bloated company to let inertia drive it off a cliff. Kodak stubbornly rooted itself in its high-margin analog photography business. It let the Sonys and Hewlett Packards of the world pass it by in digital cameras and digital printers, and ultimately collapsed in a failed rearguard effort to respond.

Today, Kodak has become a poster child for incompetence in the face of change, and a warning to all against complacency: a company stuck in its legacy business that wouldn’t adapt to the new landscape. Alternatively, it is painted as a company whose resources, capabilities, workforce, and culture were so far removed from its new requirements that it couldn’t adapt. “How could they not have seen it coming?,” we wonder, questioning our own capacity to change. “We’d better embrace the future or we’ll end up like Kodak!” we warn our own teams as we spur them to action.

Kodak failed. But not for the reasons you may think. Its story is among the most overtold of the digital age. It is also wrong. This matters not for the sake of Kodak but, for the sake everyone who draws on such stories to guide management in turbulent times. As we will see, the usual lessons drawn from cases of failure in the face of change—be bolder, embrace innovation, and risk more to win the game—can do more harm than good. If we can understand the root cause of why Kodak’s failure has been so misunderstood, we open a door to a new approach to developing strategy and to driving effective transformation. If not, we risk going down the same painful road.

The true Kodak story reveals a company that successfully overcame its (very real) early struggles and did everything right according to the old rules of classic disruption: It managed the shift in technology, it transformed its organization, it achieved its goals, and it became a leader in digital printing. But it mastered the business of digital printing just as printing itself was about to be replaced by digital viewing. Screens replaced photo paper, smartphones replaced photo albums, social media posts replaced duplicate prints, and Kodak’s world came tumbling down.

The imperative question that Kodak should raise for managers, then, is not “How do you drive a faster transformation?” but rather “How do you make sure that your transformation is the right one?”

What Kodak missed were the new rules of modern disruption— ecosystem disruption. These matter to anyone concerned with progress: whether you are growing a new venture, managing a hundred-year-old firm, leading an investment fund, setting government policy, or simply are curious about the changing context of business, understanding the shift from industries to ecosystems is critical to your success.

The threat in classic, industry-based disruption came from stealthy entrants becoming “good enough” and stealing market share in your core market—taking your piece of the pie. The threat in ecosystem disruption comes from helpful partners becoming “too good” and destroying the basis of your value creation—disintegrating the pie itself.

The real Kodak lesson: the greatest danger lies in doing everything to win, only to discover that you have won the wrong game. The old rules still matter, but they are no longer sufficient guides—two-dimensional strategy is inadequate for a three-dimensional world. If you do not expand your perspective on opportunities and threats, on rivals and partners, on the construction and timing of value creation, you are inviting failure.

In this chapter we will use the case of Kodak to introduce a new approach to crafting strategy. We will nail down the idea of an ecosystem—what it is, what it is not; and the ecosystem cycle—how ecosystems mature into industries, how industries dissolve into ecosystems. We will then develop a new concept, the value architecture, which will let us characterize our goals and our environment in a new way. With this in place, we will be able to clarify the foundations of ecosystem disruption, and to predict an entirely new category of competitive dynamics—value inversion— through which ecosystem partners can become rivals, complements can become substitutes, and winners can become losers. These foundations will equip us with a new set of perspectives and tools that we will expand throughout the book, and that you should apply to your endeavors going forward.

Kodak’s Miraculous Transformation

When Kodak engineer Steve Sasson invented the digital camera in 1975, he opened the door to twenty-five years of internal debate about whether, when, and how to incorporate digital imaging into the firm’s commercial operations. Kodak showed robust commitment and effectiveness on the technology side: between 1980 and 1990, it invested approximately $5 billion, or 45 percent of its R&D budget, in digital imaging; it made huge investments in new plants and personnel; by 2000, it had accrued over one thousand digital imaging patents.

While its technology footing was strong, Kodak’s business-side decision making around digital was incoherent and flawed throughout the 1990s. Countless articles have discussed how the combination of legacy thinking, internal politics, and competitive pressures, hampered Kodak’s digital transition. These issues highlight the universal challenges of change management—they are certainly true and certainly important. But they were not the driver of Kodak’s bankruptcy in 2012. If you focus on them, you focus on the wrong part of the story.*

Kodak began a new digital chapter in 2000, when the CEO role transitioned from George Fisher, a visionary outsider who was unable to shift internal mindsets, to Dan Carp, a trusted thirty-year insider who subscribed to the digital vision and had the internal legitimacy to drive it forward. “Today, we are experiencing a structural shift in our traditional film and paper business in developed markets,” Carp proclaimed. “To address this shift, we’ve begun a transformation that is pragmatic and bold. We are determined to win in these new digital markets, and we are creating a Kodak that is geared for success.”

Carp would open the door to ten years of miraculous, successful transformation in which Kodak became a champion in the digital marketplace. And it was not afraid to embrace capabilities beyond its own organization, as exemplified by its purchase Ofoto.com (later Kodak Gallery) in 2001, to create an online commerce platform where users could store, share, and print digital photos. Yes—Kodak ran a cloudbased social business that early in the game. By 2002, this business was growing 12 percent per month. Bloomberg dubbed Kodak “The Picture of Digital Success.”

By 2005, Kodak ranked number one in U.S. digital-camera sales (number three globally), ahead of rivals Canon and Sony. It accepted the pain of adapting to a digital world, and in 2006 it shuttered film factories around the globe and cut 27,000 jobs. Doubling down on digital, Kodak sold off its profitable health imaging business in 2007 for $2.35 billion. The cash would be deployed, in the words of Carp’s successor as CEO Antonio Perez, “to focus our attention on the significant digital growth opportunities within our businesses in consumer and professional imaging and graphic communications.” Perez had previously run Hewlett Packard’s juggernaut printer business, and his recruitment and promotion at Kodak were further proof of its commitment to digital printing. “Soon,” said Perez, “I’m not going to be answering questions about film because I won’t know. It will be too small for me to get involved.”

Kodak’s embrace of digital printing was spurred by two critical realizations. First, the company discovered the hugely attractive margins of home printing consumables. At $2,700 per gallon, black printer ink came in at number eight in the BBC’s ranking of the “10 Most Expensive Liquids in the World 2018,” beaten out by scorpion venom, insulin, and Chanel No. 5. As one former HP executive explained back in 2000, “All those digital camera owners will want to print their photos and web pages, and that’s going to sell a whole lot of printers and ink.” And selling high-margin photo paper would add even more to the digital printing profit pool.

Second, Kodak realized that many of its core capabilities could trans- fer to the new digital world: the image processing technology that enabled photo labs was valuable in digital cameras, and its prowess in chemical processes would power advantage in ink and photo paper coatings. Even Kodak’s century-long strength in business-to-business relations—the ubiquitous photo labs at supermarkets and drug stores— carried over seamlessly into the digital era. By 2004, the company was the world’s leading photo kiosk vendor earning $400 million in revenue. With superior products powered by its proprietary dry printing technology, in 2005 Kodak pushed archrival Fuji out of 4,859 Walgreens stores, taking over the retailer’s high margin photo-printing kiosk business. By 2006 it would add Walmart, Kmart, Target, and CVS to its retail footprint, with each location driving high-margin ink and photo paper sales with every click. One small retailer reported selling 200,000 digital prints per year from only four kiosks. At 39–49 cents per standard-sized print, that is a huge amount of revenue from just a few square feet of floor space. By 2007, with 90,000 retail kiosks literally printing money across the United States, Kodak was dominating the sector.

How do you push a top competitor like Fuji out of a top account like Walgreens? Not by being complacent; not by being incapable. You do it only through great execution by great teams with great products and services.

Kodak’s leaders had seen the light and joined the fight, realizing that the business model of the film business, where the sales of the consumables powered extraordinary profits, transferred beautifully to the world of digital photo printing. By 2010, Kodak had fought its way to number four in the inkjet printer market, where it joined the likes of Hewlett Packard, Lexmark, and Canon. Perez’s claim to analysts in 2011: “You will see that [the digital printing] business is going to be a gorgeous business for this company.” And for a brief moment, he wasn’t wrong.

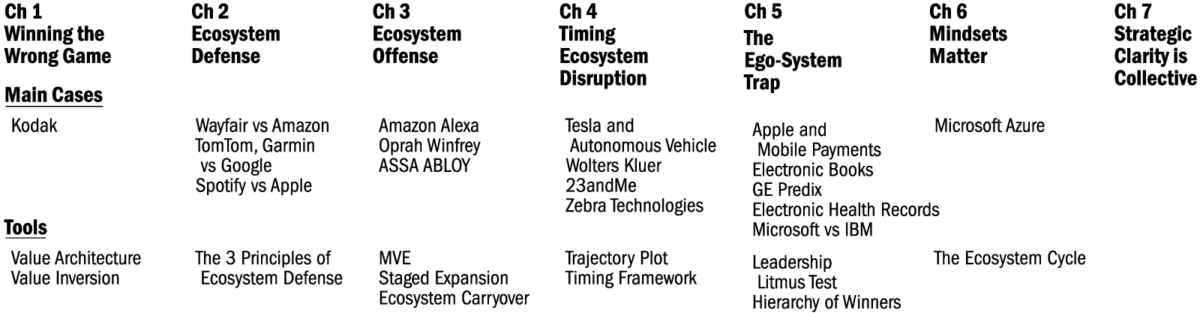

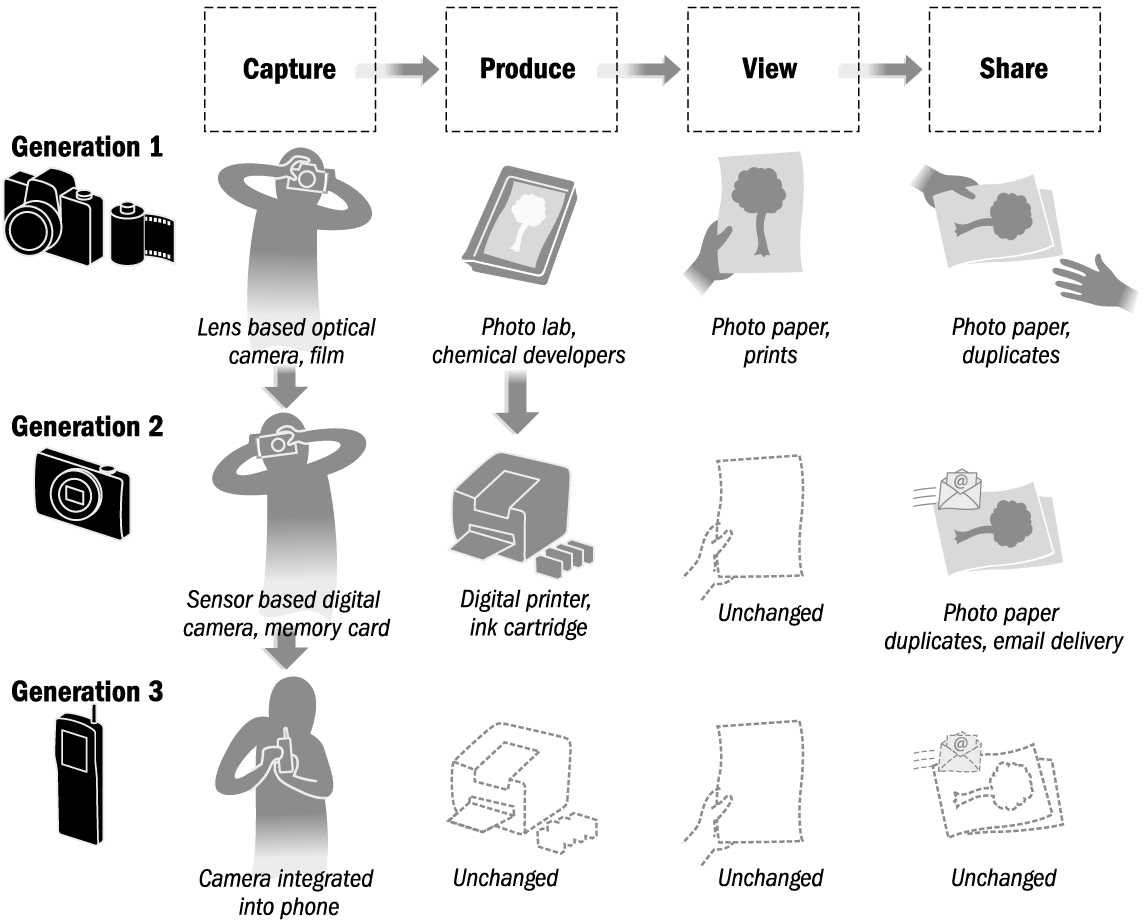

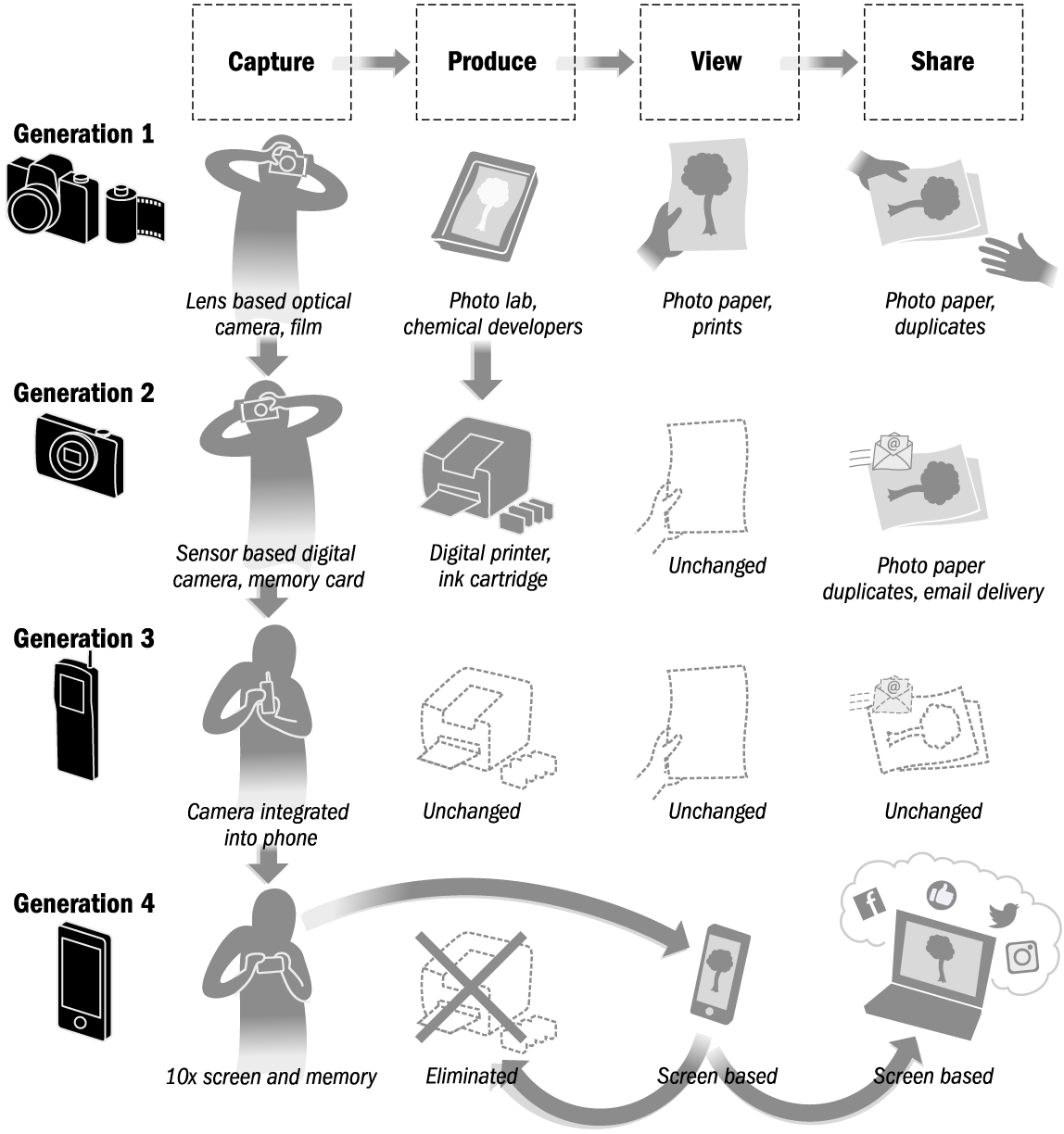

Figure 1.1: The technology shifts that underlie the transition from optical imaging to digital imaging.

The evidence is clear: Kodak did not “miss” digital. Where the world claimed that the radical technological leaps of figure 1.1 would be impossible, Kodak showed that the impossible could be achieved. Its management did the wrenching hard work of shifting from an analog- printing profit base to a digital printing profit base. It succeeded. And yet it still failed.

So What Went Wrong?

This is what winning the wrong game looks like: Kodak achieved its goal of becoming a significant player in the market for digital printing. But the market for digital printing itself collapsed as digital impacted not just how photos were captured and printed, but also how they were consumed. Kodak collapsed not because it did not succeed in its transformation into a digital printing company, but because digital printing became largely irrelevant with the rise of digital viewing and sharing. Kodak’s value creation was upended not by a rival or a direct substitute, but by shifts elsewhere in its ecosystem. It fell victim to the ecosystem dynamic of value inversion.

Where do modern consumers keep and view their photos? Not in albums; not in shoe boxes; not in wallets. And how do they view these images? Not on paper. The paper print was replaced by the digital screen, the photo album by the phone in your pocket and a library in the cloud. These, in turn, reset the customer value proposition as the once-famous “Kodak Moment” became the Instagram moment, no longer a matter of framed photos but online posts. By 2019, over fifty billion photos had been uploaded to Instagram, where they were eminently shareable but hardly ever printed.

In short, Kodak won its hard-fought battle to become a digital printing company only to be crushed by digital viewing. This is a different kind of disruption.

The Need for a New Approach

Kodak was focused on managing technology disruption—mastering a transition across technology regimes. What it missed was the dynamic of ecosystem disruption—the shift at the very foundation of its value creation.

The Kodak story is compelling because it provides a perfect illustration of where, how, and why classic strategy breaks down in the face of ecosystem disruption. It should make you pause and think. Why did Kodak’s leadership get it so wrong? Why has its story been so fundamentally misunderstood? Most importantly, what could your own organization be missing?

With hindsight, everything is obvious. But in practical terms, applied to your enterprise, is it realistic to expect you and your managers to craft forward-looking strategy that plans for these moving pieces? Is it fair to demand this higher level of insight? Is it reasonable, given all the other demands and challenges that need to be managed?

Yes. Yes. And yes. It’s realistic, fair, and reasonable, as long as you are prepared. Creating ecosystem strategy requires a different perspective, new concepts, and new tools for understanding dynamics when traditional boundaries are broken, and new value propositions are created.

Let’s get started.

Breaking Industry Boundaries Breaks Industry-Based Strategy

Kodak was not defeated by other printer makers, but by the rise of screens. Nokia was not defeated by traditional handset makers, but by the rise of mobile software applications. And taxi fleets were not defeated by other medallion holders but by the rise of ridesharing platforms. The nature of competition, and of competitors, is changing.

Classic industry analysis defines industries according to their location along a value chain, an input-output sequence going from suppliers to focal industry firms to buyers. Think silicon wafer producers (e.g., Sumco) to focal semiconductor manufacturers (e.g., Intel) to computer assemblers (e.g., Lenovo). This flow has clear directionality and clean boundaries across roles. If you shift the point of focus, the sequence shifts too—move one step to the right to consider semiconductor manufacturers to computer assemblers to distributors (e.g., Best Buy). In this conceptualization, business strategy is focused on how to compete within each industry box, and corporate strategy is focused on picking which industry boxes to be in. Firms compete inside these industry boxes pursuing advantage through different combinations of cost and quality: Ford battles General Motors to win more car buyers; Kellogg’s battles General Mills to win more breakfast cereal eaters; ABC battles NBC to win more evening news viewers. Their ability to capture value is determined by their ability to man- age their rivalry, bargain with buyers and suppliers, confront substitute threats, and contend with new entrants, as characterized by Michael Porter’s famous Five Forces framework.1

The “classic disruption” twist on industry analysis—Clayton Christensen’s powerful attack-from-below model—expanded consideration beyond head-to-head rivals to focus on threats presented by entrants who used a different technology to capture market share on the basis of lower costs and prices: discount airlines such as Southwest attacking full-service carriers; mini mills like Nucor disrupting integrated steel mills; and Conner’s lower capacity 3 1⁄2-inch hard disk drives replacing the higher capacity 5 1⁄4-inch technology generation. Early technology limitations would initially constrain these entrants to serving only unattractive buyer segments, but as their technology improved and their offers became “good enough,” they would capture increasing share and disrupt the mainstream market.

These classic disruptors changed how the game was played, but they did not change the game itself. Their production methods were different, but their offers and their goals fit neatly within the industry boundary: Southwest still sold airline tickets, Nucor still sold steel; Conner still sold disk drives. They disrupted industry incumbents with new technologies, but they played the same game for the same prize. The industry box remained the same.

A fundamental problem with industry analysis is that it presumes what constitutes an “industry.” The notion of an industry turns out to be incredibly fuzzy. It relies on some shared sense among participants regarding where the activities begin and end; a common understanding of which customers rivals are competing over and how those customers segment; and a consistent view of what is central and what is peripheral.

In the past, we could ignore this fuzziness because the relevant participants acted in a relatively consistent way—CVS, Walgreens, and the local pharmacist varied in their organization, scale, and their strategy, but they all based their success in selling goods and dispensing drugs. We could simply assume a “retail pharmacy industry,” and move on to strategizing competition. But today’s CVS, rebranded as CVS Health, includes not just a retailer (which, as part of its 2014 health-focused transformation, proactively chose to stop selling all tobacco products, voluntarily forfeiting $2 billion of its annual sales), but also Minute- Clinic (walk-in clinics that offer basic healthcare services in retail locations), Caremark (the United States’ biggest pharmaceutical benefits manager, which manages the drug reimbursement plans for 94 million insured patients), and Aetna (one of the country’s biggest health insurers, with 37.9 million covered lives). By weaving together activities and offers, CVS Health is attempting to move beyond mere diversification to redefine the game. The notion of a well-defined “retail pharmacy industry” breaks down in the shift from filling prescriptions to managing health and wellness. CEO Larry Merlo has termed this the “retailization of healthcare.” CVS Health is attempting to redefine not only the value proposition for the end customer, but also the underly- ing way in which customer value is brought into being. In so doing, it has shifted its efforts from competing in separate industries to creating a new ecosystem.

This is a different world. The guidance of “assume an industry and then proceed” worked when market boundaries were clear, when rivals’ goals were consistent, when the pattern of interaction among participants was well established and uncontested. But this guidance becomes ineffective in the face of structural change and multifaceted value propositions.

With an industry lens, we can see the trajectories of improvement inside an industry box and we can see the threat of direct substitutes that seek to replace us inside the box. This lens, however, leaves us blind to the forces that impact the relevance of our value from outside the traditional box. Using an industry lens, feature phones can improve and be replaced by smartphones, but phones can never become substitutes for printers (wrong—this is precisely what took down Kodak); better tractors can only benefit the seed and fertilizer industries (wrong—today’s intelligent tractors reduce the volume demand for seed and fertilizer through high precision planting that makes every seed count and eliminates waste); and more efficient, easier delivery options are better for restaurant owners (wrong—services like Uber Eats and DoorDash have taken over customer relationships and made restaurants more interchangeable with one another).

It is precisely when industry boundaries are contested and redrawn that traditional industry-based strategy reaches its limits and the need for an ecosystem strategy arises. Traditional strategy risks focusing us on the wrong part of the problem, leading to situations like Kodak winning the battle for technology transitions but losing the war for relevance. The classic strategy tools were not designed to navigate these new waters. And, sure enough, they don’t.

As the boundaries of competition change, so too must our approach to regulating competition. Traditional measures of market power and market concentration become increasingly inadequate in the face of boundary-breaking firms. We will see the potential for both overestimating and underestimating the power of ecosystem disruptors in our discussion of offense and defense in chapters 2 and 3.

What Is an Ecosystem? And What Is Not?

Industry boundaries cannot guide strategy when the boundaries them- selves are shifting. What, then, is the alternative? To navigate the changing landscape, we must necessarily begin with a characterization of the value to be created—the value proposition:

Definition: A value proposition is defined by the benefit that the end consumer is supposed to receive from your efforts.

Deciding on your value proposition is the crucial first step to understanding any ecosystem. The value proposition is the articulation of the benefit that the collective effort of the ecosystem will create, and hence sets the direction of the activities and collaborations that follow. Kodak’s value proposition, for example, was the Kodak Moment, which we can elaborate as “reliving and sharing memories through images.”

Beyond articulating the benefit, the value proposition also specifies the end consumer. In contexts with multiple partners and intermediaries, deciding on the end consumer is a strategic choice of its own. For Kodak in the home market, this was the photographer who both captured the moment and then relived it when flipping through albums or admiring the picture on a mantle shelf. Other actors, such as photo- finishers and retailers, were critical to creating the value, but they were not the end consumers of the Kodak Moment.

A compelling value proposition is the first step toward success. It is here that we draw on customer insight, identify the core nature of the “jobs to be done,” and follow the mantra of “obsess over the customer.”

Consider your own value proposition. How confident are you in it? How clearly do you communicate it? Is your team’s articulation consistent with your own? With that of your customers’?

Customer insight and the right value proposition, however, are only a beginning. Insight does not transform into action on its own. What matters is what you deliver in the end. The core of our approach is to connect the value proposition to the activities that bring it about, both within your organization and in partner organizations—how we should think about the construction of value. This is what drives us to focus on ecosystems.

So what is an ecosystem? Over the past decade, the term “ecosystem” has become pervasive in discussions of strategy, both scholarly and applied. With growing (over)use, it risks becoming vacuous. In most current business conversations the word “ecosystem” can be replaced with the word “mishmash,” without affecting the meaning of a sentence. Its overuse is an indicator that managers are very much attuned to the need to incorporate other actors into their strategies. Its ambiguity is an indicator of a desperate need of clarification.

I have found the following definition to be most helpful in my own thinking about ecosystems. It underlies the conceptual approach that we will take in this book:

Definition: An ecosystem is defined by the structure through which partners interact to deliver a value proposition to the end consumer.

There are three keys aspects to this definition:2

- First, the anchor is a value proposition. By orienting the ecosystem around a value creation goal, we avoid being trapped in the perspective of a single firm or technology.

- Second, there is an identifiable set of specific partners that choose to interact to create the value proposition. An ecosystem is multilateral—it cannot be understood simply by breaking it down into a series of bilateral buyer-supplier relationships (if it can be, you are looking at a complex supply chain that doesn’t require new tools to manage or negotiate within).

- Third, the ecosystem has structure—the actors are aligned in a collaborative arrangement, with defined roles, positions, and flows among them. If you are only looking at lists of stakeholders you are missing the vital role of structure; if you are only concerned with attracting an increasing number of affiliates to your platform, you are missing the vital role of alignment. The heart of ecosystem strategy is finding a way to align partners into the structural arrangement (i) that you want them in; and (ii) that they are willing to occupy.

We will come back to this definition throughout the book. It will provide guidance especially when we consider what it means to lead in an ecosystem (chapters 5 and 6).

The Ecosystem Cycle

Value creation is always a matter of collaboration and interdependence. It is the need to achieve alignment—to establish a stable, routinized pattern of roles and interactions among the value-creating partners—that makes strategy in an ecosystem different from strategy in an industry. Before alignment is achieved, the strategic focus for firms is to establish the structure of partnerships and collaborations that will deliver the value proposition; after alignment is achieved, the focus shifts to negotiating the terms of exchange and advantage within the now established structure.

This means that as ecosystems become established, they mature into the stable, structurally embedded patterns of exchange that we come to recognize as industries. Conversely, when those patterns are disrupted, the critical need to find a new pattern of structured interaction shifts industries back to an ecosystem mode. This is the ecosystem cycle. An ecosystem lens let us understand industries in flux.3

Hence, in 1905, establishing the automotive ecosystem required settling on a pattern of mutually agreeable roles, positions, and flows among the producers of the “iron horse,” distributors of fuels, providers of maintenance services, risk managers, and so on. It was only after this alignment structure was stabilized that boundaries became identifiable, allowing us to think in terms of industries: the car industry, the garage service industry, the car insurance industry, regulatory bodies, and so on. Today, the rise of the autonomous vehicle in conjunction with electrification and on-demand mobility services such as Uber and Lyft is calling the established structure into question, forcing participants to revisit the current industry boundaries as they wrestle to establish the meaning and structure of the “mobility ecosystem.”

The notion of ecosystems is not new. Aligning interdependent activity has been a defining challenge since the dawn of civilization—the ancients had to figure out road networks, aqueducts, governance, and more. What has changed dramatically in the last decade, however, is the frequency with which firms are trying to create new ecosystems, and the number of ecosystems that they are trying (or are forced) to participate in simultaneously. This intensification has been spurred on by the digital revolution. It is unlikely to disappear any time soon.

Where are your strategic goals impacted by the need to drive, or respond to, shifting alignment? Keep this context in mind as we lay out our approach to seeing and managing ecosystem dynamics.

Understanding Ecosystems through Value Architectures

Ecosystem disruption occurs when change escapes the confines of a given industry or technology box to reverberate across the system. To understand ecosystem disruption, we need a way to distinguish change at the level of technologies and industries from change at the level of the value proposition. To accomplish this, I would like to introduce a new concept—the value architecture.

Definition: A value architecture is defined by the elements that are brought together to create the value proposition.

The value architecture is the schema through which we will represent and organize the concepts that underlie the benefit that we deliver to the end consumer: the value elements. These elements are abstract ideas—category labels—that we will use as building blocks for thinking about how a value proposition comes together.

The value architecture is a way for an organization to structure its answer to a critical question: What are the building blocks that make up our value proposition? As we will see, anchoring our thinking in the elements of value will let us look beyond the firm, beyond technologies, and beyond industry boundaries in ways that will allow for a new kind of analysis.

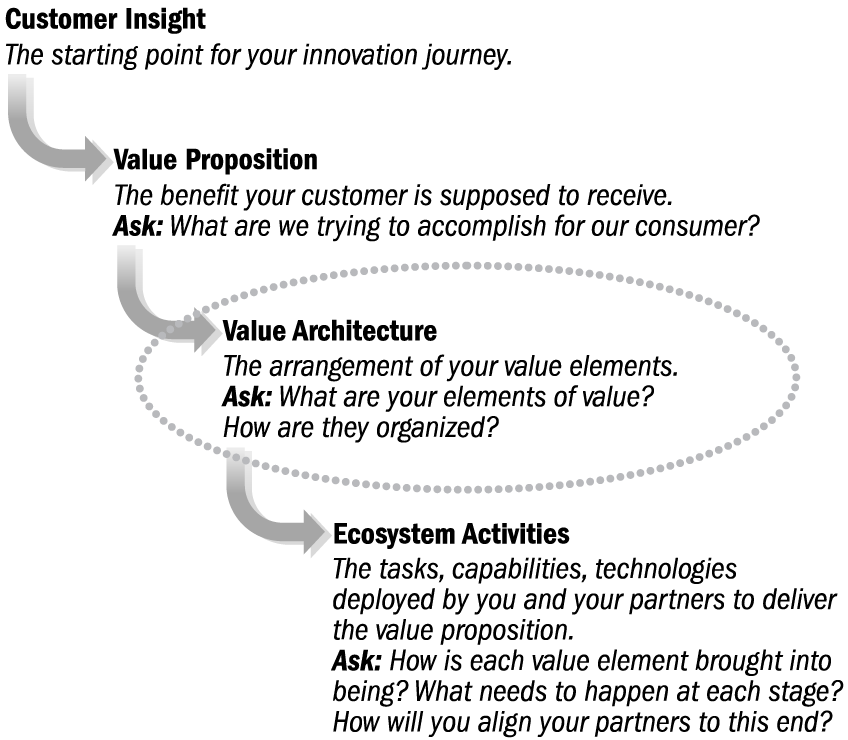

To develop a value architecture, we start with the original customer insight, articulate the holistic notion of the value proposition that addresses the insight, and then deconstruct it to the underlying elements of value.

For example, if we consider Kodak’s value proposition of “reliving and sharing memories through images,” we can identify four value elements: Capture the moment; Produce the image; View the image to relive the memory; and Share the image with others (figure 1.2).

The value architecture is not static—it is a strategic choice that can evolve. We will see in chapter 2, for example, how online home furnishings retailer Wayfair adapted its value architecture in response to Amazon’s entry into its space. This was the key to transforming its proposition from “selling you furniture online” (where the key value elements were Selection, Transaction, and Delivery) to “creating the home you love” (with the addition of the new elements of Discovery and Deliberation). The elements of Wayfair’s value architecture are brought about through partners, activities, and technologies (server farms, search algorithms, inventory management systems, etc.). But it is the value elements, rather than the technologies, that give shape to its value proposition.

It is only after this value architecture is clear that we should move to the more detailed level of tangible activities: the tasks, components, technologies, and ecosystem partners that move us from the conceptual level to interaction with the real world. It is at this level that we consider value chains, supply chains, resources, and capabilities. Value blueprint maps of the ecosystem operate at this level as well (figure 1.3).†

The concept of value architecture presents a different unit and level of analysis than we are used to in the realm of strategy:4

- The value architecture is not defined in terms of technologies, physical components, activities, or the engineering relationships that link them.

- The value architecture is not a business model. Where a business model is focused on how you operate to get paid by a customer, a value architecture is focused on how you construct the value that underlies your customers’ willingness to pay for your offer.5

- The value elements of the architecture are not steps in a value chain, an activity system, or a value stream. They do not have to trace the path of activity and material flows.

- The value elements of the architecture are not defined by the attributes and preferences that consumers have in mind when they evaluate products or services. Thus, while they aggregate to create the value proposition, the individual elements do not necessarily correspond to the way end customers think about the world.

Focusing on the value architecture liberates us from anchoring our analysis on the basis of technological forms and artifacts (supply side), and allows us to conceptualize in terms of the elements of value creation (demand side). It lets us distinguish between changes that occur within the traditional boxes of specific elements (how activities are getting done), and changes whose impact is felt across value elements (how activities contribute to the value proposition).

Do you and your organization have a systematic grammar for discussing what underlies your value proposition? Some version of a value architecture approach? Most organizations do not. Instead, when thinking about value creation, they—like the strategy literature—articulate a value proposition and then default to thinking in terms of their activities, technology choices, and organizational structure. But in doing so, they limit their ability to manage change: their activities, technologies, and organizational structures define their blind spots.

Let’s revisit the Kodak case to see how applying a value architecture perspective yields a systematic approach to understanding the process of ecosystem disruption.

Kodak’s Value Architecture: A Clearer Picture

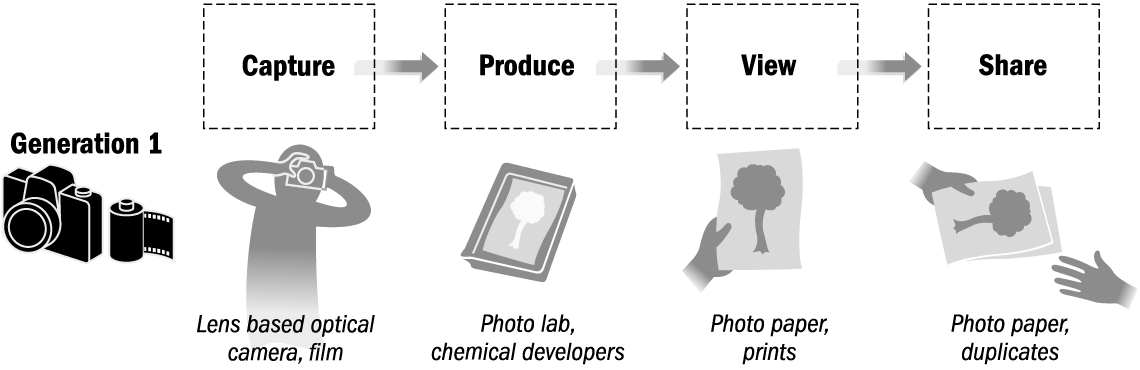

To assess the dynamics of ecosystem disruption using a value architecture, we start with the elements of value and then consider how changes in the activities within any given value element can impact other elements. In our version of Kodak’s value architecture, we can see how in the old world of chemical photography (call it Generation 1), Capture was accomplished with optical cameras and film; Produce with photo labs and chemical developers; View with the high-quality paper print that users enjoy; and Share with the duplicate prints given to friends and family (figure 1.4).

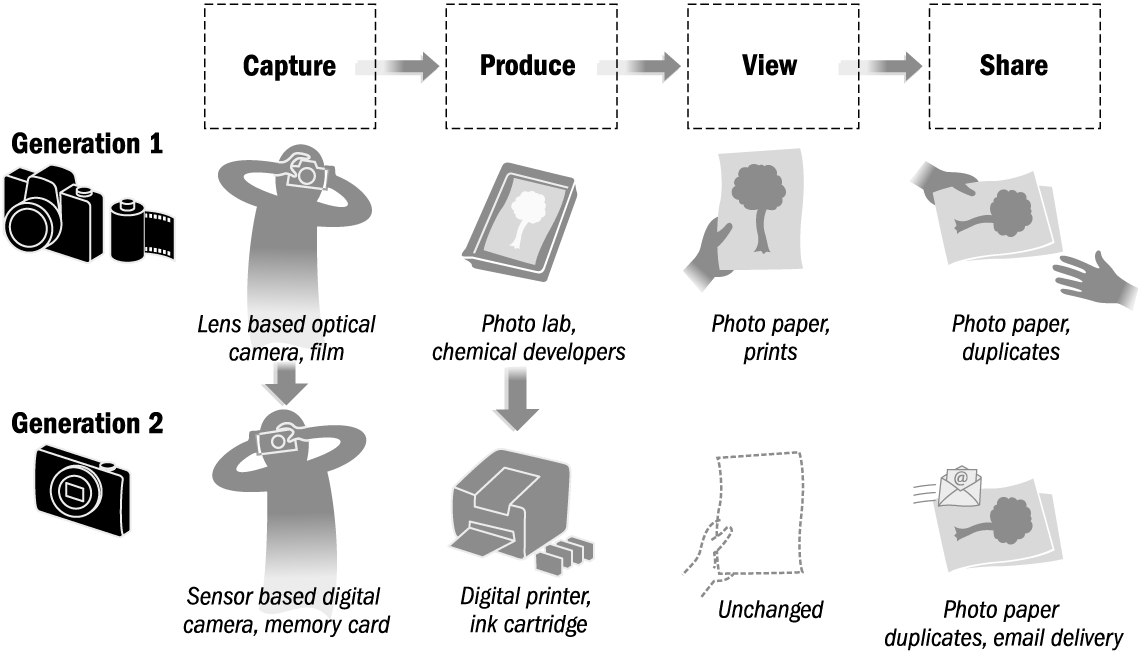

The initial transition to digital photography (Generation 2) entailed changes in Capture and Produce. In Capture, optical cameras using lenses and film were replaced by digital cameras using sensors and solid-state memory cards. The sensor resolution determined the quality of the image that could be captured, and the memory card’s capacity determined the number of photos that could be stored. These shifts represented a radical, competence-destroying technological change. In Produce, photo labs and chemical developers were replaced by digital printers and ink cartridges. These too were radical shifts (figure 1.5).

Not all elements are impacted in radical ways, however. While the production technology changed, View was still accomplished through high-quality paper prints that could be placed on mantles, carried in wallets, or organized in family albums.

The transition to digital images enabled a meaningful change in the element of Share, allowing for friends and family to receive photos over the Internet rather than receiving printed duplicates directly from the person who took the photo. Note, however, that from the perspective of a firm concerned with photo printing, this shift was very positive: email enabled sharing image files with more people, increasing the likelihood that a given image would be printed, and hence contributing to paper- and ink-based profits. Indeed, facilitating the digital sharing of then-to-be-printed photos was the logic behind Kodak’s acquisition of Ofoto.com. In this regard, the rise of photo-intensive social net- works like Myspace (founded 2003), Facebook (2004), and Flickr (2004) could be seen as positive for sharing and printing as well. As we will see, however, this positive relationship changed dramatically with the introduction of superior displays in Generation 4.

Classic industry-level disruption was taking place within these boxes— but not across them. While inside-the-box transitions are hard to manage, the challenge is well understood. Indeed, as we saw, it was precisely these challenges that Kodak managed so well.

As digital photography continued to progress (Generation 3), Capture underwent another transition as technology improvements and cost reductions in sensors and memory allowed phones to incorporate cameras. This was classic substitution (figure 1.6). While it was terrible news for the sale of standalone cameras, it was good news for phone makers. It was also good news for everyone else in the ecosystem: more cameras that were easier to access with more memory and better resolution meant more great photos were captured, leading to more pictures to print and share. “Reliving and sharing memories through images” remained a compelling value proposition. Kodak’s decision to focus on printing consumables rather than digital cameras as the core of its digital profit engine was prescient in this regard. Indeed, reading the tea leaves correctly, while Kodak continued to sell standalone digital cameras, it transferred all production from its own lines to a contract manufacturer, exiting the capital-intensive part of the business just as camera phones were about to decimate the standalone camera market.

Further component improvements helped give rise to the smartphone (Generation 4). The 2007 introduction of Apple’s iPhone and its large touch screen changed the way users interacted with their phone- based applications, giving rise to the tactile interface of Angry Birds and making “swipe right” a cultural meme. This was, initially, more good news for photo printing as consumers flocked to smartphones with better cameras and components, taking more and better pictures.

But as screens became big enough and sharp enough (“retinal quality display” was Apple’s tagline), something dramatic happened. Viewing pictures on the phone was no longer just a matter of squinting at a pixelated representation as you were taking a photo or selecting a download. The smartphone took on a new role as a display: it became a substitute for viewing pictures on paper. Components intended to improve the device in Capture began to have an impact on View.

And with this leap across boxes—the spillover from one value element into another—we have ecosystem disruption. The upheaval in View would reverberate across the system. First, eliminating the need for paper in View would impact Produce. The breakdown of boundaries between the elements meant that the value of printers, papers, inks, and all the big, beautiful profits Kodak had bet on in the Produce box would soon evaporate. Second, the shift in View would drive a shift in Share. Not only would shared images no longer be printed, but with the rise of social media, the very notion would expand from sharing visual memories with a close circle of others to sharing moments and seeking “likes” from friends and strangers alike.

The first two transitions in the digital imaging story maintained the integrity of the boxes—all the action comes from the vertical arrows in figure 1.6. For this reason, these transitions all fit the mold of classic disruption and technology substitution. Using the tools of traditional strategy, Kodak was able to manage these with aplomb. It is the last transition, precisely because of its cross-box impact that marks the dynamic of ecosystem disruption—the action is in the horizontal arcs in figure 1.7. Ecosystem disruption arises when a change in one element of value changes the game in another element.

While the notion of a paperless world had long been discussed in theory, it had never materialized in practice. Digital images and software for editing and searching had been widely available for decades, but they were used in the service of choosing and improving images for ultimate printing. It was only with the rise of ubiquitous, high-quality, connected displays that physical print production of photos was upended. Here we can see how software eats the world, but only after hardware has set the table.

Value Architectures Shape Perspective

Articulating an explicit value architecture is critical in the context of ecosystem disruption.

Why did Kodak and its later analysts miss the dynamics of ecosystem disruption? Because they defined their world in terms of supply-side transitions of products and technologies. Consider figure 1.1. This schema highlighted only the leaps required to succeed in a world of classic, inside-the-box, disruption. But using a technology lens left them blind to cross-box dynamics: they could be correctly confident that a camera will never be a printer. From this perspective, it is impossible to see how a camera component could become a threat to printing.

Having an explicit value architecture opens the door to distinguish- ing between transitions that respect the boundaries of the traditional industry boxes of specific elements (classic disruption—a change in how activities are getting done) and those whose impact is felt across value elements (ecosystem disruption—a change in how activities contribute to the value elements that underlie the value proposition).

Your value architecture is a critical choice. The same value proposition can be characterized by very different value architectures and elements. These different architectures will reflect different philosophies of how to approach the given value proposition. As such, they cannot be judged according to some absolute metric of correct versus incorrect. Rather, they can only be assessed on the spectrum of helpful versus unhelpful, enabling versus limiting, shared versus idiosyncratic. The specific choice of value architecture is critical, however, because it has a profound impact on how a firm will interpret changes in its environment, how it pursues opportunities, how it will approach aligning its partners, and how it will deliver its ultimate value proposition. Indeed, the value architecture is the method through which we can give meaningful shape to otherwise vague notions of differentiation and the drivers of consumer willingness to pay.

The value architecture lens focuses us on the construction of value, and, in this way, surfaces change that reverberate beyond a single industry box and across the ecosystem. Throughout the book, we will use it to explore dynamics that will add to our understanding of strategy, organization, and leadership. Let’s begin by nailing down how helpful partners can transform into rivals.

Value Inversion: How Friend Turns Foe and Drives Ecosystem Disruption

The Kodak story is both jarring and instructive. It is jarring because Kodak was felled not by a traditional rival (Fuji did not outcompete them in film), not by a new technology that it could not master (it became a digital printing powerhouse), and not by a failure in customer insight (its core value proposition—the Kodak Moment of reliving and sharing memories through images—remained relevant to the market). It is instructive because it shows how defaulting to an inside-the-box technology-based perspective can blind an organization to critical shifts. Blind spots have consequences.

Classic disruption happens when a new technology or mode of activity replaces another through direct substitution. Digital cameras take over the job of optical cameras; digital printers take over the work of chemical photo labs. The change takes place in a single box and stays there: cameras remain cameras, printers remain printers.

Ecosystem disruption is a different animal. Here, a change in one location impacts another location: the camera starts doing the job of the paper, and thereby eliminates the need for the printer. This is a disruption that is not about mere substitution, but about redefinition of value. How can we improve our ability to see it coming?

To understand the dynamics of ecosystem disruption, we must anchor our thinking in terms of value elements. This lets us explicitly consider how changes that arise in one element can reverberate to impact other elements across the value architecture. Regardless of whether your own organization participates in the originating element, if that element is part of your architecture, you need to be actively considering its potential impact on you.

When you observe a change affecting any element, you must ask the bigger questions: How is it affecting every element? How does that affect your plan?

If this sounds more involved than your usual analysis, you are right—it is. But you need only consider Kodak’s collapse, driven by surfaceable “unknown knowns,” to appreciate the tragic, avoidable cost of not engaging in this analysis. Andy Grove, the legendary CEO of Intel, was famous for saying, “Only the paranoid survive.” Digging into your value architecture is how to turn that paranoia into productivity.

The key difference between classic disruption and ecosystem disruption is that the source of the threat does not start as an opponent, but as a benign cocreator of value. To understand this, we need to revisit the interactions that lead to value creation and value destruction.

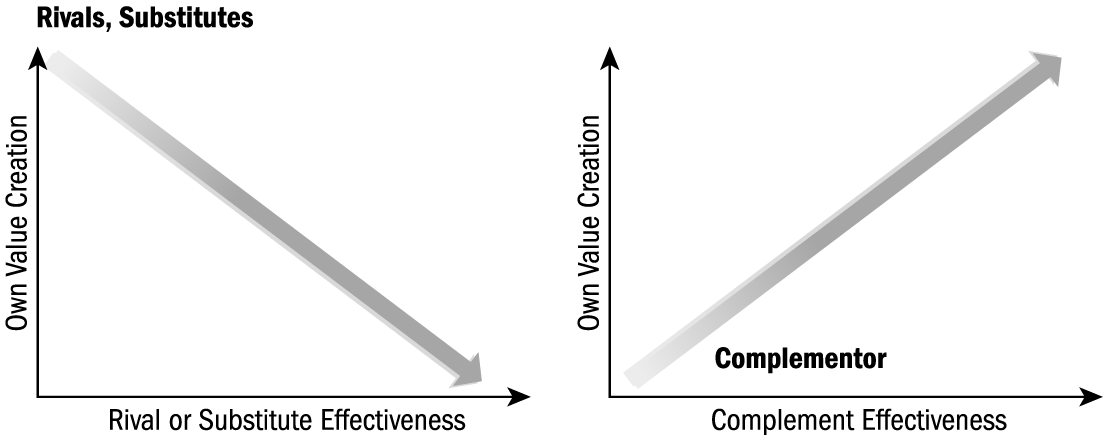

Basic economics distinguishes among three types of actors relative to a focal organization (you): rivals, substitutes, and complements.

- Classic rivals are trying to win the same race in basically the same way. If you are Sony PlayStation, Microsoft Xbox is a direct rival in the market for video game consoles. As the effectiveness of your rivals improves, your added value is reduced, and you are strictly worse off (figure 1.8, left).

- Classic substitutes are also trying to win the same race as you, but in a different way. If you are Sony PlayStation, potential substitutes include smartphones and online gaming platforms, like Steam or Google Stadia, that allow users to play video games without the need for specialized hardware. As the effectiveness of your substitutes improve, you are strictly worse off (figure 1.8, left).

- Classic complements, in contrast, enhance your value. Complements present their own distinct offers, and these offers enhance the value of your focal product. If you are Sony PlayStation, complements include the games developed for your console and the online discussion communities that bring gamers together. As your complements improve, they increase the value created by your offer and leave you strictly better off—indeed, this is formal economic definition of complementarity (figure 1.8, right).

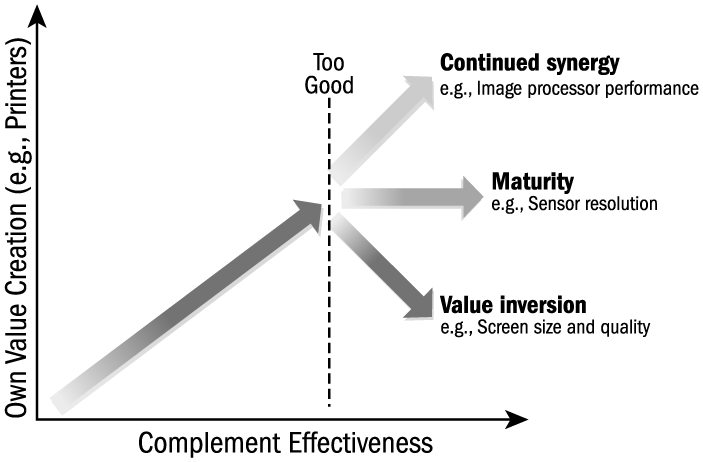

Complementors can disrupt the core firm in three different ways. First, they can act in ways that commoditize the core market (e.g., the Microsoft-Intel Wintel standard commoditizing computer assemblers like IBM). Second, they can enter the core market as direct rivals through vertical or horizontal integration (e.g., Netflix entering the market for video production). It is the third mode, however—value inversion— that is our main interest here. Whereas the first two modes manifest in reduced margins and market shares, the third mode undermines relevance, a far more devastating threat (losing your market is worse than losing your margin).6

Understanding ecosystem disruption requires a critical revision of our view of complements: While the initial contribution of all complements is, by definition, necessarily positive, their continued development can give rise to very distinct paths (figure 1.9). Some complements continue to enhance the focal offer’s value as they improve (Continued synergy). Others reach a point beyond which their own continued improvement stops impacting the focal offer (Maturity). Most critical for understanding ecosystem disruption is the third trajectory (Value inversion), whereby the complement’s continued improvement beyond a certain point inverts their effect, and begins to undermine the focal offer’s value. This is the dynamic through which your complements are transformed into substitutes—your partners become your threats.

The profound realization is that a complement can become “too good” and begin to undermine your value creation. Moreover, this can happen without any change in the direction or intent of the complementor. In classic disruption, substitutes that become good enough can threaten to obsolete your technology for creating value. In ecosystem disruption, complements that become too good threaten to obsolete the very value you create. This is a fundamentally different kind of challenge.

The Three Complementor Trajectories

Let’s explore these trajectories using Kodak, taking the perspective of a firm whose profit base is rooted in selling the inks, papers, and printers that bring about the Produce element of digital imaging.

The baseline relationship is that smartphones with digital cameras are a complement to digital printing: increasingly ubiquitous and easier-to-use phones that have improved cameras increase the number of pictures taken, which increases the number of printing-worthy images, which increases the number of printed images, which increases ink and paper use, which leads to Kodak’s planned digital profits.

Note that even though Kodak pulled back from selling cameras itself, Capture remained an important element of its value architecture because of its critical impact on allowing Produce to contribute to the overall value proposition, which remained the Kodak Moment.

Consider three different components that contributed to the improving smartphone cameras: image processors that allowed for features such as intelligent focus and blur reduction; sensors that determined the resolution with which images could be captured; and screens that allowed the user to see and compose her shot without squinting through a tiny viewfinder.

These three component technologies illustrate the different trajectories that complements can follow: Continued synergy, Maturity, and Value inversion.

Trajectory 1: Continued synergy. We usually think of complementor effectiveness as an unmitigated good: the better our partner gets, the better the partnership; the better the component, the better our product. In the Kodak case, the image processor is purely synergistic: better image control makes for better pictures, which make for more picture taking, which leads to more pictures worth printing.

Trajectory 2: Maturity. Some complements are subject to decreasing marginal utility from performance improvements—their continued improvements begin to matter less and less as they get past a certain performance level. For example, in the early days of digital photography increasing sensor pixel density was critical to the value proposition. Two-megapixel cameras took grainy, low-resolution pictures. As sensors improved to offer four, six, and eight megapixels, photo quality improved markedly and printed images matched the quality of traditional chemical prints even in larger size formats like 4 × 6 inches and even 8 × 10 inches. Beyond a certain point, however, additional resolution enhancement did not matter. The difference between a twenty megapixel camera and a thirty megapixel camera is only material for wall-sized prints that are irrelevant for the bulk of users. This dynamic, where customers stop valuing performance improvements, often leads to commoditization among producers of the complement, but leaves the focal firm unscathed.

Trajectory 3: Value inversion. Value inversion is a reversal of the beneficial relationship between complement and core. It results in the displacement of the core offer from the market as the very foundation of its value creation is undermined. This dynamic is particularly salient across value elements, but it is easy to overlook.

The concept of value inversion being introduced here is new to the existing strategy literature, and its implications are profound. Value inversion is what underlies the ecosystem disruption that led to Kodak’s downfall. It is the dynamic through which a complement that contributes to value creation in one element (Capture) undermines value creation in a second (Produce). Better screens were, initially, an unmitigated positive from the perspective of printing firms. As their size and resolution increased they allowed for better, easier, and more confident picture taking.

But as screens moved from the back of dedicated cameras to the front of ubiquitous smartphones, with improved resolution and larger size, the quality of an image viewed on the device screen began to match the quality of a printed photo. The value relationship between core (photo printing) and complement (camera) began to change from positive to negative. Suddenly, the improved camera with its improved screen, which was pursued to enhance the element of Capture, was affecting value creation in a new location—the element of View. The smartphone camera began impacting value creation in a new way, in a new place. This is the beginning of value inversion. The inflection point in figure 1.9 marks the transition of smartphone cameras from printing complement to printing substitute.

The effect was magnified by other improvements in the camera, such as greater storage capacity and image management. This is ecosystem disruption, and it set the stage for further upheaval, as better connectivity, the emergence of the mobile cloud, and the rise of social media networks supercharged the impact.

All of your partners are complementors—they help you create your value. At the start of your journey, your relationship is positive, by definition. This relationship, however, can change over time, and do so dramatically. Unlike traditional attackers, disruptive complementors are not new entrants to an industry; rather, they already occupy a position in the ecosystem, with all the benefits that come from established relationships with partners and customers. Understanding the trajectories on which they lie is therefore critical for assessing your true competitive context. You can craft strategy to accommodate partners on each of the trajectories, but your plan will vary dramatically depending on which of the three trajectories they lie. The key is to see the reflection of partners’ performance improvements in your own value architecture.

Predicting Value Inversion: Surfacing the Unknown Knowns

While we can never overcome the existential risk of missing the “unknown unknowns,” too often we see firms fail for missing what, in fact, were “unknown knowns”—information that was available, but inadequately framed within the larger context. By asking a new set of questions and offering a new perspective, we will multiply our odds of success.

Value inversion collapses the boundaries between the industry boxes and drives ecosystem disruption. The disruptive force is resident in the ecosystem, not as a threat, or in some hidden, latent state, but as a visible and (initially) helpful and productive contributor. It is this initial contributory role that makes value inversion invisible to traditional strategy tools until it is too late. This is the reason that ecosystem disruption can only be understood from a perspective that starts with the construction of value. We will see this manifest in the ways in which firms adapt their value architecture to blunt ecosystem disruption (chapter 2), as well as how they position for advantage as they build their value architectures and align partners to drive disruption (chapter 3).

The seeds of value inversion are easily overlooked, but that does not mean they are impossible to detect. While the early signals may be weak, we can be proactive in amplifying their future effect with a thought experiment. Ask: How would my value architecture be impacted if a given partner presented a tenfold increase in performance and a tenfold decrease in price?

If infinite performance improvement at a zero price point makes you happy, you are safe from value inversion. If it makes you nervous, keep probing.

Here is poignant irony: even as Kodak’s printing strategy was blind to the implication of ever-improving screens, Kodak was itself enjoying success with a product that was the canary in the coal mine: the standalone, Internet-connected digital picture frame. This dedicated, single-purpose screen allowed users to upload and view photos without the need to print them. Sales of digital frames in the United States grew from $180 million in 2006 to $904 million in 2010, and Kodak was, for a time, the market leader. But digital frames were dismissed as rapidly commoditizing novelty items: “They’re complicated. They’re annoying. No one ever updates the pictures on them.” All true. And even today, standalone digital frames have not replaced the mantle-shelf paper photos displayed in most homes. But dismissing something as a novelty risks ignoring its impact.

We can see a different implication of digital frames if we know to look for ecosystem disruption. To do this we need to:

(1) think of extreme improvement in performance and price: not by a factor of two but ten, or twenty; and

(2) query the implications across all the elements of our value architecture, not just the current location.

From this vantage point we can begin to see the potential of cross-element substitution. We can see screens taking on the value-creation role of paper; we can see digital storage taking on the role of photo albums; we can see digital transmission eliminating the printing of duplicates. And in looking at our environment, we can see low-cost, high-performance screens becoming ubiquitous with the rise of smartphones. We have a structured way of seeing and explaining the potential of screen-based phones, with ever-increasing storage and connectivity, to become digital picture frames on steroids. And hence become substitutes for printing.

There is no crystal ball, of course. But if we know how to look for the right clues in the present, we can see quite a lot of the future.

The Power of Perspective: Lexmark as a Case of Proactive Response

Can ecosystem disruption really be predicted? Printer maker Lexmark’s response offers a clear demonstration that (1) it is possible to read the writing on the wall; and (2) it is possible to be proactive even when you cannot change trends.

Lexmark was focused on document printing, rather than photo printing, but faced conditions nearly identical to Kodak’s. The computers and screens that had powered so much document printing were becoming more ubiquitous, portable, and connected—value inversion was in Lexmark’s future as the digital office threatened to become the paperless office.

In Lexmark’s 2010 annual report, CEO Paul Rooke laid out the clear imperative: “Lexmark’s customers are . . . reducing physical handling, movement and storage of hardcopy documents, as well as reducing unnecessary and wasteful printing.” Translated in our terms: the value architecture is being disrupted, the elements of View and Share are changing; screens are replacing paper, value inversion is nigh, and that is just how it is going to be.

Recognizing the irreversibility of this trend, Lexmark’s response was to revisit and reinvent its architecture. The critical realization was that digital information creates opportunities for new value creation. In response, it used its still-robust shares to engage in a spate of acquisitions, sold off its printer hardware business, and used the proceeds to fund additional investments in document and workflow management. Rooke explained, “As we found ourselves managing these multifunction devices that have scanners built into them, we found ourselves capturing content off of paper and into digital infrastructure, and we’re looking to do more of that than we have been. You’ll see us do more interpretation of content and automatically routing documents according to what’s on them.” Lexmark would shift its focus away from paper printing and toward the management of digital documents. By recognizing—and embracing— what it understood as a soon-to-be-unsustainable position in printers, it was able to shift its own direction in time. The key, of course, is that it started on this path while still in a position of some strength.

Starting with the $280 million purchase of Perceptive Software in 2010, Lexmark would go on to acquire a total of fourteen software companies, building up capabilities and market presence. The outcome? Lexmark was acquired by a private equity consortium in a $4 billion transaction in November 2016. When compared to its November 2009, pre-transformational journey enterprise value of $1.7 billion, we see evidence of a remarkable non-collapse, and a far better fate than bankruptcy as a pure-play digital printing company relying on ink sales for survival.

Responding to Ecosystem Disruption

The trajectories of smartphone cameras, screens, and storage in the Kodak case are a powerful illustration of complements becoming substitutes and devastating competitiveness. In the Kodak case, we see how this can happen even in the absence of strategic intent—the iPhone was not developed to kill the market for photo printing; screen makers were not dreaming of taking over the market for photo paper. In this case, the loss was inflicted incidentally, as collateral damage, by firms that started the journey as partners and allies. This is a seismic shift in the truest sense: earthquakes wreak havoc, but don’t attack with intent—they “just” happen.

Clearly, Kodak was in no position to stop the transition to the digital consumption of digital images and the ensuing disruption of the printing business. No one was. But had it understood the dynamics of ecosystem disruption it could have altered its own course. Furthermore, if Kodak’s leadership had recognized the potential for ecosystem-based disruption, it could have pursued a number of other options. These include:7

Specialize. Compete in digital imaging but focus on spaces that will continue to benefit from component improvements. If Kodak had anticipated the exponential increase in digital images that consumers would take and store with their ubiquitous smartphone cameras, it could have built on the vast, cutting-edge portfolio of sensor and image-processing technologies that it had developed and in which it held over 1,100 patents and commanded billions of dollars in licensing revenues (for access to its “218” patent alone, Kodak was paid $550 million by Samsung and $414 million by LG). Had it chosen a different focus—or just split its bets—it could have been a dominant player in the sensor market, where Sony makes billions today. A move to specialize should build on internal strength but, as we saw with Lexmark, can be powerfully augmented with targeted acquisitions.

Extend. Consider what side businesses might be moved to center stage. Kodak was an early mover in cloud-based photo management, most notably with the acquisition of Ofoto. But its focus was on encouraging photo sharing to drive photo printing rather than on embracing the social net- working trend. If it had taken more seriously the issues of image storage, management, and sharing it might have prioritized the Share element, or derived a new element, such as Archive, recognizing that near-infinite storage increases the need for smarter search and retrieval options.

Diversify. Recognize the fragility of your position and don’t concentrate your bets. In its eagerness to push into digital printing, Kodak’s leaders sold off attractive parts of the company, most notably the medical imaging business. If the ecosystem-based risk had been better appreciated, they would not have put so many of Kodak’s eggs in the single basket of printing. Diversification was the choice pursued by archrival Fuji who, facing a similar landscape, chose to move beyond the photo business, instead deploying its chemical-based capabilities to innovate in other markets, most notably pharmaceutical development and production.

Find a niche. If you can’t come up with a positive course of action, conserve your resources until one arises. In the worst case, consider repositioning to a defensible niche, from which you can then launch new initiatives. The opportunity in photo printing has not disappeared, but it has morphed from printing stacks of 4×6-inch photos to specialty printing of photobooks, wall art, personalized gifts, and special images by commercial printers.

Such alternatives were certainly debated within Kodak. But without a full appreciation of the ecosystem dynamics—and without a strategic language to articulate nervous intuitions—these concerns could not get the attention they deserved. This eased the way to the disastrous decision to bet the company’s future on the soon-to-evaporate market for digital photo printing. Kodak squandered a fortune on its digital printer effort and, in the end, did not have enough capital to mount a proper defense of its patent base.

Winning the Right Game

In the face of ecosystem change, strategic options are numerous. But they can only be pursued with confidence and effectiveness if they are understood in the context of the bigger picture. The Kodak story shows the dangers of interpreting shifts solely in terms of activities and technologies. Applied to your own unique situation, the lesson is that regardless of the driver of change—new entrants, new technologies, societal pressures—understanding the cross-box implications of a change is critical to effectively managing the challenges and opportunities it creates. You must look beyond the innovation to understand its impact on the definition of value elements in order to safeguard your own value creation and continued relevance.

Your value architecture is also a lens for considering your role in the broader context. The rise of stakeholder capitalism is expanding corporate mandates beyond maximizing scale, efficiency, and shareholder value. At the same time, the rise of ecosystems creates the opportunity to reimagine not just your value proposition and your competitive context, but the fundamental relationships that underlie them. By unpacking the assumptions that underlie your value creation—structuring a deliberate assess- ment of the objectives you choose and the constraints you focus on—your value architecture offers a roadmap for linking stakeholder imperatives to your strategy, and for linking your strategy to stakeholder imperatives. As we consider approaches to innovating architectures and aligning partners in the chapters that follow, recognize that these ideas apply to interdependent settings in general, and so can be applied to enhance effectiveness well beyond the commercial marketplace.

Competing effectively in the new arena requires a new perspective. It requires us to zoom out and think through problems at the level of the ecosystem in which we operate, rather than solely at the level of our product, our firm, or our industry. Otherwise, we risk Kodak’s fate— winning the hard-fought struggle only to discover too late that we won the wrong game.

Understanding your game means having clarity regarding your value proposition and the elements that you see as underlying its construction— your value architecture.

Your value architecture offers a critical lens through which to under- stand, navigate, and initiate moves in the ecosystem game. Tradi- tional competition and classic disruption—which remain enormously important—pose one set of threats from inside the box. Value inversion and ecosystem disruption, however, create a new set of challenges (and opportunities) that operate along different dimensions from outside the box. An expanded view of the board gives the clarity that will enable us to build more robust, more successful ecosystem strategies.

With these foundations in place, let’s think about how to play the game proactively—how to shift from sensing to shaping as we confront ecosystem disruptors. We will start with a focus on ecosystem defense (chapter 2) which will let us better understand ecosystem offense (chapter 3).

Chapter 2

Ecosystem Defense Is Collective

"He who defends everything defends nothing." —Fredrick the Great

Imagine spending years nurturing a vision for transforming your industry. Imagine having persuaded your investors to stay the course on this crazy journey, having finally coaxed your partners into an alignment that supports your value proposition, having finally brought your product to market, getting a first taste of success—and then confronting a targeted ecosystem disruption.

Kodak was upended as collateral damage from the progress of complementors elsewhere in its ecosystem. Ecosystem disruption, however, is often strategic—arising from the focused efforts of players determined to take over your space. Ecosystem disruptors range from startups to giants. In their mature manifestation they draw resources and momentum from adjacent market spaces and enter not with a stealthy knock but with a battering ram. What now?

What if you are Daniel Ek, struggling for nine years to establish Spotify’s music streaming offer as a viable business model, and just as things are finally coming together in 2015, Apple crashes your party with an all-out push for Apple Music?

What if you are Niraj Shah and Steve Conine, having finally established Wayfair as the Internet’s premier home furnishings retailer, and you wake up on a bright April morning in 2017 to Amazon’s announcement that the furniture sector is its next major priority?

What if you are Harold Goddijn, leading Dutch satellite navigation giant TomTom in 2008, facing the nightmare that Google—which until yesterday was your biggest single client for mapping data services—has just launched Google Maps as a competing service, open to all, and at a price of zero? Not only are all smartphones free substitutes for your core GPS device business, but with Google’s open approach to data, companies who would otherwise pay for your geodata can now get it for free.

Each of these firms was “born digital” and wore the mantle of “indus- try disruptor.” But each then found themselves in someone else’s crosshairs, confronting a bigger rival armed with its own disruptive agenda. Apple, Amazon, and Google held vast power, resources, and ambition. On paper, Spotify, Wayfair, and TomTom should have been crushed. If they had followed the old rules of industry competition they probably would be. Yet, years into the sustained attacks of the ecosystem giants, they vary from surviving to thriving.

When confronting an ecosystem disruptor, smart defenders must mobilize multiple pieces of their own ecosystems to create a collective shield. We will see how, instead of the usual head-to-head response, each of these firms played an expanded game. They followed the principles of ecosystem defense to enhance their value architectures and adapt their partner coalitions. An ecosystem defense is a collective defense—if you are doing it alone, you are doing it wrong.