The Wide Lens What Successful Innovators See That Others Miss

Table of Contents

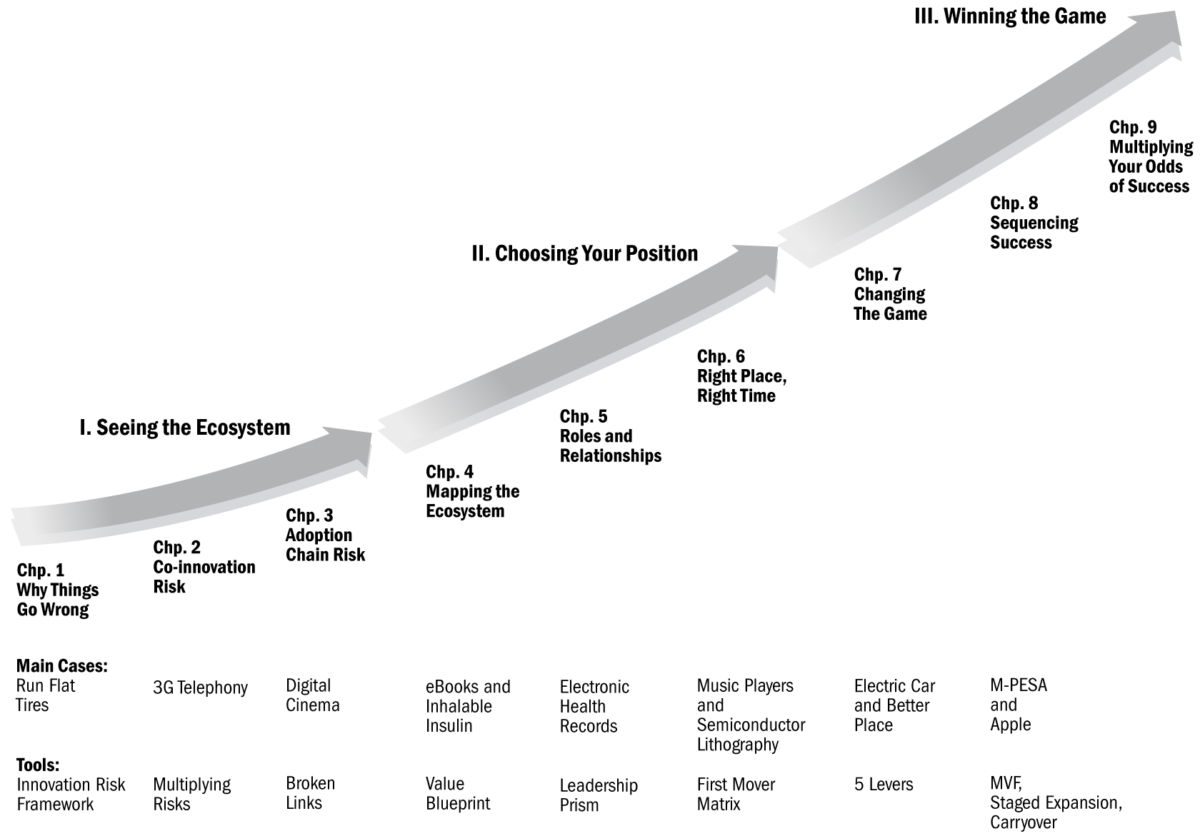

- Introduction

- Ch 1: Why Things Go Wrong When You Do Everything Right

- Ch 2: Co-Innovation Risk: Seeing the Real Odds When You Don’t Innovate Alone

- Ch 3: Adoption Chain Risk: Seeing All the Customers Before Your End Customer

- Ch 4: Mapping the Ecosystem: Identifying Pieces and Places

- Ch 5: Roles and Relationships: To Lead or Follow in the Innovation Ecosystem?

- Ch 6: The Right Place and the Right Time: When Does the Early Bird Get the Worm?

- Ch 7: Changing the Game: Reconfiguring the Ecosystem to Work for You

- Ch 8: Sequencing Success: Winning the Connected Game

- Ch 9: Multiplying Your Odds of Success

Introduction

This book is about the difference between great innovations that succeed and great innovations that fail. It is about the blind spots that undermine great managers in great companies even if they identify real customer needs, deliver great products, and beat their competition to market. It is about why, with ever greater frequency, your success depends not just on your ability to execute your own promises but also on whether a host of partners—some visible, some hidden—deliver on their promises too.

The innovation blind spot is everybody’s problem: whether you are a CEO or project team member; in a large multinational or an emergent start-up; in the corporate sector or at a nonprofit; contributing to a collaborative effort or investing in one. No matter your situation, your success depends not just on your own efforts but also on the ability, willingness, and likelihood that the partners that make up your innovation ecosystem succeed as well.

This book offers a new perspective—a wide lens—with which to assess your strategy. It introduces a new set of tools and frameworks that will expose your hidden sources of dependence. It will help you make better choices, take more effective actions, and multiply your odds of success.

The Innovation Blind Spot and Avoidable Failure

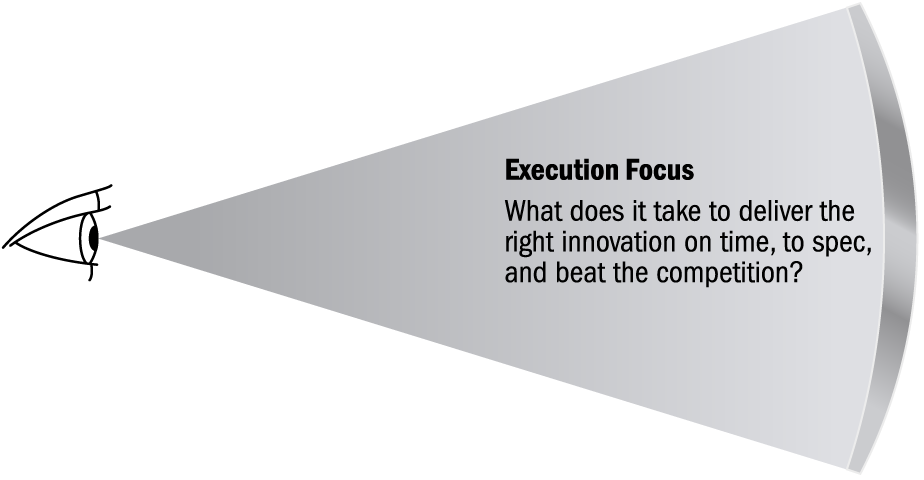

Execution focus—developing customer insight, building core competencies, and beating the competition—has become the touchstone of business strategy. In myriad books, lectures, meetings, and workshops, the message to managers is to focus on linking their strategy and their operations, on aligning their teams, on monitoring their competitive environment, and on revitalizing their value propositions. This, they are told, is critical for success.

Yes. Great execution is critical—it is a necessary condition for success. But it is not enough. While this execution focus draws attention to unquestionably important parts of a company’s environment—its management, employees, owners, customers, and competitors—it creates a blind spot that hides key dependencies that are equally important in determining success and failure.

Philips Electronics fell victim to this blind spot when it spent a fortune to pioneer high-definition television (HDTV) sets in the mid-1980s. The company’s executives drove a development effort that succeeded in creating numerous breakthroughs in television technology, offering picture quality that customers loved and that the competition, at the time, could not match. Yet, despite sterling execution and rave reviews, Philips’s high-definition TV flopped. Even the most brilliant innovation cannot succeed when its value creation depends on other innovations—in this case the high-definition cameras and transmission standards necessary to make high-definition TV work—that fail to arrive on time. Philips was left with a $2.5 billion write-down and little to show for its pioneering efforts by the time HDTV finally took off twenty years later.

Sony suffered from a similar blind spot, winning a pyrrhic victory as it raced to bring its e-reader to market before its rivals, only to discover that even a great e-reader cannot succeed in a market where customers have no easy access to e-books. And Johnson Controls, which developed a new generation of electrical switches and sensors that could dramatically reduce energy waste in buildings and deliver substantial savings to occupants, discovered that unless and until architects, electricians, and a host of other actors adjusted their own routines and updated their own capabilities, the value of its innovations would never be realized.

In all these cases, smart companies and talented managers invested, implemented, and succeeded in bringing genuinely brilliant innovations to market. But after the innovations launched, they failed. The companies understood how their success depends on meeting the needs of their end customers, delivering great innovation, and beating the competition. But all three fell victim to the innovator’s blind spot: failing to see how their success also depended on partners who themselves would need to innovate and agree to adapt in order for their efforts to succeed.

Welcome to the world of innovation ecosystems—a world in which the success of a value proposition depends on creating an alignment of partners who must work together in order to transform a winning idea to a market success. A world in which failing to expand your focus to include your entire ecosystem will set you up for failure. Avoidable failure.

Innovation, Expectations, and Reality

Every year, the calls for new innovation to safeguard economic growth, technological progress, and general prosperity grow louder. Every year, vast amounts of money, time, attention, and effort are spent to introduce productive change. From new products and services, to new technologies and business models, to new personnel assessment systems and incentive programs, to new government policies, new education initiatives, and new reporting procedures, innovation initiatives blanket our lives and organizations.

How can we increase profitable growth? Innovate! How can we be come more efficient and reduce waste? Innovate! How can we improve loyalty and increase customer satisfaction? Innovate! Innovation is a problem for everyone because it is held up as the solution for everything.

But, despite the excitement, energy, and hype, successful innovation remains the exception rather than the rule. According to surveys by the Product Development and Management Association (PDMA), approximately one out of four new product development efforts ever reach the stage of commercial launch. And even within this highly screened group, 45 percent fail to meet their profit objectives.

Despite these odds, innovation remains imperative. In a world of aggressive competition and easily bored customers, innovation is not a choice but a necessity. A 2010 study by the Boston Consulting Group (BCG) found that 72 percent of senior executives cited innovation-led growth as one of their top three strategic priorities. And if you listen to government leaders and nonprofit heads, you know that their chorus of calls for innovation is deafening. The challenge, then, is to understand the causes of innovation failure and to find ways of increasing effectiveness and safeguarding success.

The experts—authors, gurus, academics, consultants, CEOs—tend to fall into two schools of thought in explaining the sources of failure and the path to success. The first school argues that most innovation failures are rooted in a shortfall in customer insight. Introducing a genuinely new product or service is not enough; if customers don’t see the innovation as uniquely valuable, or are unwilling to pay the required price, then the innovation will not succeed. Success, they argue, requires a better way to generate the really good ideas that customers will embrace. The second school argues that failure is rooted in shortcomings of leadership and implementation. They claim that the key to success lies in building better capabilities for execution and implementation that will enable us to deliver on our promises and beat the competition.

Both perspectives are crucial to understanding and achieving successful innovation. But, even taken together, they are incomplete. Every serious manager today has been inculcated in the mantra of “listen to the voice of the customer” and “focus on execution.” And yet, innovation success remains as elusive as ever. Even when firms come up with great new ideas and follow them up with great implementation, failure is not only possible but likely. How can we do better?

Seeing the Hidden Traps

As the long history of failed innovation efforts shows, overlooking your blind spots often leads to tragedy. Good people work hard but ultimately waste their time on initiatives that won’t succeed—not because they are less innovative than their competitors or because they can’t execute on their project, but because their innovation ecosystem won’t come together. If they had the tools to see and understand how their success depends on others, they would have done things differently.

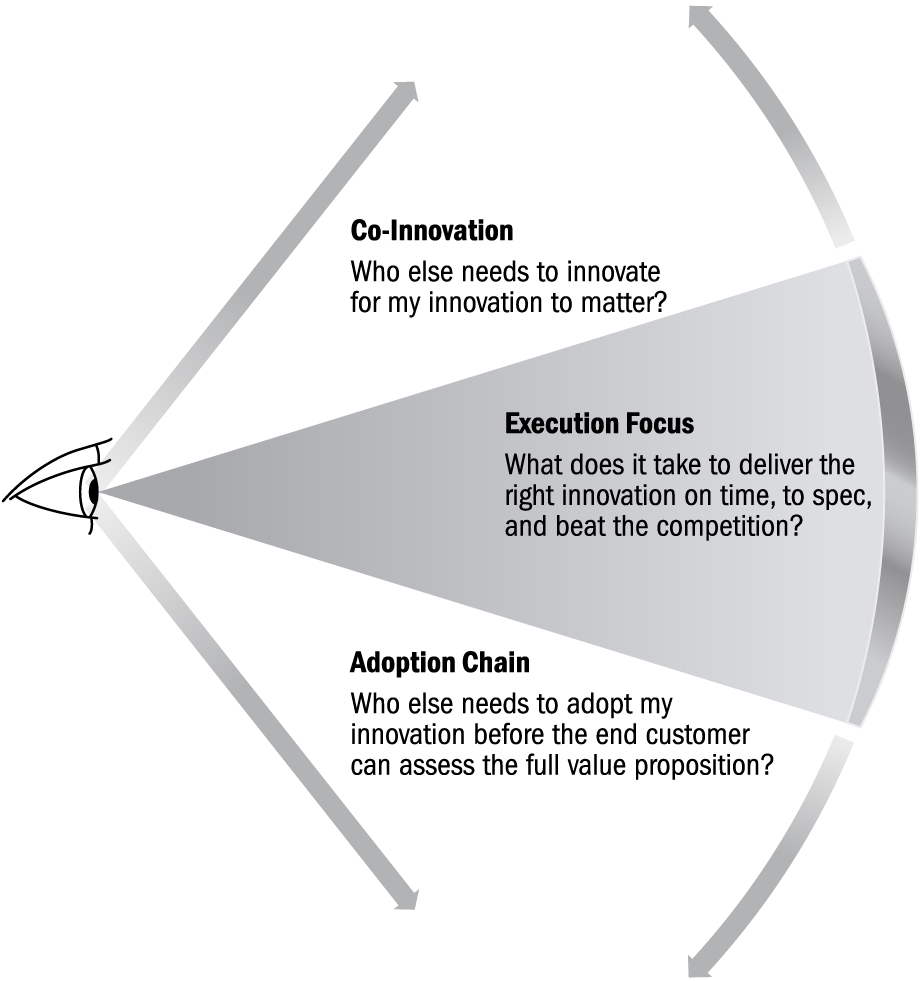

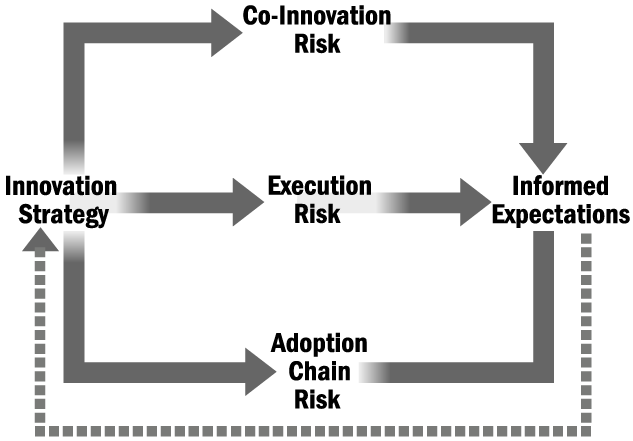

This book is designed to help managers, leaders, and everyone concerned with innovation see their hidden dependencies and understand how to develop robust strategies that are more likely to succeed. To start, you must consider two distinct types of risk that arise within ecosystems: Co-innovation Risk, the extent to which the success of your innovation depends on the successful commercialization of other innovations; and Adoption Chain Risk, the extent to which partners will need to adopt your innovation before end consumers have a chance to assess the full value proposition.

Choosing to focus on the ecosystem, rather than simply on the immediate environment of innovation, changes everything—from how you prioritize opportunities and threats, to how you think about market timing and positioning, to how you define and measure success. This new paradigm asks innovators to consider the entire ecosystem by broadening their lens to develop a clearer view of their full set of dependencies. To be sure, great customer insight and execution are still vital. But they are only necessary—not sufficient—conditions for success.

How We Got Here

The need for collaborative innovation has defined progress since the Industrial Revolution—the lightbulb on its own was a miraculous invention but needed the development of the electric power network to turn it into a profitable innovation. What has changed is the way the collaboration is organized. The shift toward innovation ecosystems follows a historical trend toward greater complexity and interaction that has characterized the rise of the modern economy.

In the beginning, the dominant approach was to house all this complexity within a single firm—the vertically integrated organization. In the early days of the twentieth century, vertically integrated companies like Ford, GE, BASF, and IBM showed that large size, reduced variable cost, and dedicated research could produce outstanding change. But while vertical integration offered control, it required massive investments and led to huge, unwieldy organizations. At the close of the twentieth century, firms like Toyota, Dell, and Nestlé led their industries by learning how to leverage external supply chains to outsource activities, reduce fixed costs, and increase operational flexibility, setting a new benchmark for competitiveness that their rivals struggled to meet.

At the beginning of each management innovation wave, the first firms to master the principles of the new approach—from assembly-line manufacturing in the 1920s to management information systems in the 1950s to relational contracting, just-in-time inventories, and total quality management in the 1990s—enjoyed a substantial competitive advantage. Rival firms looked on in awe, trying to figure out what magic allowed for such vastly superior results. But as these innovation strategies diffused more broadly across organizations, their mastery stopped being a source of differentiation and became, instead, simply an operational requirement for getting in the game.

Today we are witnessing another transition point. The enormous benefits that accrued to firms who mastered supply chain management—global procurement, just-in-time-production, lean inventory management—are still real, but they are now widely shared. In industry after industry, we see a major change taking place as firms shift from using supply chains to offer better products to embracing partnerships and collaboration to offer better “solutions.” It isn’t enough for an auto manufacturer to produce a reliable, fast, efficient car: it also needs to offer state-of-the-art computer navigation and entertainment systems. It isn’t enough for hardware stores to sell a variety of goods efficiently: they also need to design classes and tutorials so people can learn how to use them. Newspapers must offer both articles and videos; marketers must offer both advertising campaigns and user communities; phones must offer not just voice calling but an entire media experience. Success in this world requires mastery of ecosystem strategy.

There is a growing trend to not go it alone. In a 2011 survey of senior executives by the Corporate Executive Board, 67 percent expected new partnerships, and 49 percent expected new business models, to be critical drivers of their growth in the upcoming five to ten years. And indeed, today’s exemplar firms—from Apple in consumer electronics to Amazon in retail, from Roche in pharmaceuticals to Raytheon in defense, and from Hasbro in toys to Turner in construction—do much more than “just” execute flawlessly on their own initiatives. They orchestrate the activities of an array of partners so that their joint efforts increase the value created by their own initiatives many times over. These leaders have understood the nature of the blind spot and have expanded their perspective. They have deployed a wide lens in setting their strategy and prospered in their embrace of the ecosystem opportunity.

The Wide Lens

Luck—good and bad—always plays a role in determining outcomes. But in every postmortem analysis of failure, we uncover two different types of surprises: the ones we couldn’t have seen coming and the ones we should have.

All too often we see strategies devolve into tactical adjustments, hurriedly and reactively pursued to compensate for realities that could have been foreseen. The old tools are no longer enough. They may have clarified how to think about customers, competition, and capabilities, but they offer precious little guidance on how to think and act in an interdependent world.

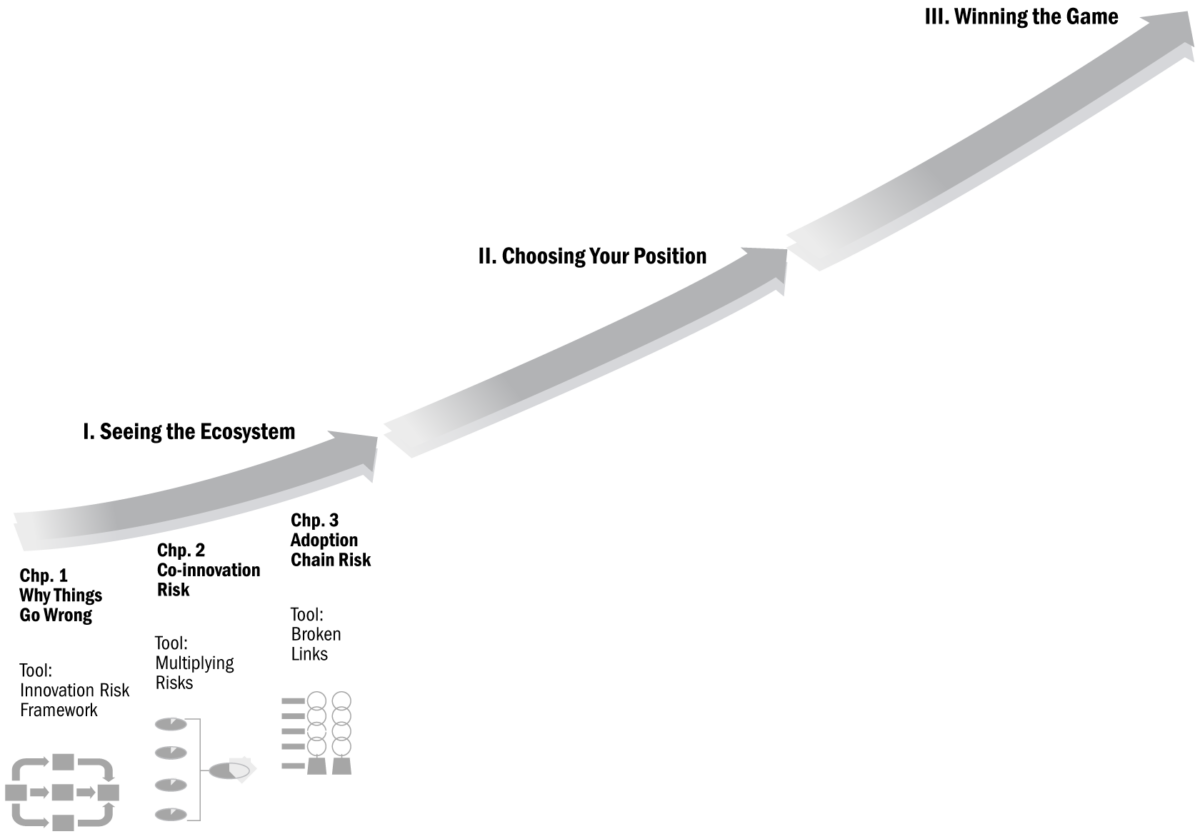

This book will give you a new set of tools with which to craft your strategy and build your success. The ideas in each chapter build on each other, and as you progress, you will increase your understanding, your toolbox, and your odds of success.

In part 1, I introduce the key concepts that make innovating in ecosystems different, beginning with an examination of why excellent managers can become so focused on their own execution that they fail to recognize the extent to which their success depends on others. We will see how co-innovation risk and adoption chain risk combine to create the innovation blind spot and why there is a natural tendency for these problems to stay hidden from view (and correction) until it’s too late.

In part 2, we move from analysis to choice in the context of ecosystems. We will explore how to assess alternatives, how to choose positions, and how to think about timing. We will see why a wide-lens perspective fundamentally changes how we decide where to compete, how to compete, and when to compete.

In part 3, we shift from choice to intervention. I will present a set of new strategies for building and shaping ecosystems—how to reconfigure the structure of dependence and how to leverage advantage within and across ecosystems. We will see how the wide lens toolbox can be credibly deployed to avoid needless failures and multiply your odds of success.

Dependence is not becoming more visible, but it is becoming more pervasive. What you don’t see can kill you. Don’t let your blind spot become your downfall.

Part 1. Seeing the Ecosystem

Chapter 1

Why Things Go Wrong When You Do Everything Right

Like a drumbeat, the mantra of success echoes through the halls of every organization: (1) “Put the customer first,” (2) “Deliver on your promise,” and (3) “Do a better job than the competition.” Each individual directive presents a formidable organizational challenge, but serious managers know that the real challenge lies in satisfying all three requirements simultaneously.

A great idea that excites your organization but not your customer creates no value. A great idea that you cannot implement is a theoretical dream. And a great idea that you implement, but which the competition implements better, is at best a disadvantaged effort and at worst a waste of both time and resources.

So what should we expect if we pull off the miracle and combine a great idea and great execution? In a world of stand-alone projects, where outcomes are determined by how well you and your team deliver on your initiative, the answer is success. But over the past two decades we have witnessed a systematic shift away from independent success. As customers get bored and competitors catch up, firms are trying to break out of the commodity trap by finding ways to leverage products and services provided by other partners to drive their own success.

More and more, managers and executives are being pushed into a world of greater collaboration. The upside is that, by working in concert with others within and across organizations, you can accomplish greater things with greater efficiency than you could ever accomplish alone. The downside, however, is that your success now depends not just on your own efforts but on your collaborators’ efforts as well. Greatness on your part is not enough. You are no longer an autonomous innovator. You are now an actor within a broader innovation ecosystem. Success in a connected world requires that you manage your dependence. But before you can manage your dependence, you need to see it and understand it. Even the greatest companies can be blindsided by this shift.

Michelin’s Run-Flat Saga

In the early 1990s, Michelin was in an enviable position. Best in class by a host of measures and an industry leading brand (who can forget the iconic Michelin Man?), the company was not only the largest tire maker in the world but also the most innovative. With a long history of successful innovations stretching back to its beginnings in the late 19th century, Michelin was always looking for new opportunities to create value and grow.

In 1992, a small group of Michelin executives conducted a breakout session. The goal? To come up with the next big innovation, one that would spur sales, grow profits, and redefine the way consumers would think about tires. The result—the PAX System—was an idea so good, so powerful, that it launched Michelin on an ambitious path to transform the entire tire industry. “The PAX System is our biggest technological breakthrough since we patented the radial tire in 1946,” the company proudly announced. “In simple terms, we have reinvented the tire.”

The PAX System was a run-flat tire that would continue to “run flat” and not sacrifice performance even if punctured. If you suffered a blowout with run-flat tires, you could continue to drive as if nothing had happened. No need for an emergency pull-over. No need to get out the spare tire and jack from the trunk. And no need to call a tow truck and wait by the side of the road until it finally arrived.

Instead, a light on your dashboard would let you know a puncture had occurred and that you could drive for another 125 miles, at up to 55 mph, before having to pull into a garage to get the tire repaired affordably and efficiently. Here was a truly great innovation—one that would make customers’ lives easier and safer, while driving new profitable growth for the company. “The adoption of the PAX System is inevitable,” said Thierry Sortais, the PAX project director, summing up Michelin’s expectations. High expectations indeed!

Michelin saw the run-flat as a revolutionary growth engine not only for the company but for the entire tire industry. Despite the importance of tires—“the single most important component on a vehicle,” according to Motor Trend magazine—the tire industry was brutally competitive, marked by overcapacity and low margins. Making things worse, the majority of drivers did not differentiate among tires, regarding one brand as good as another, and therefore chose their tires largely on the basis of price.

A half century earlier, Michelin had commercialized the radial tire, a breakthrough innovation that dramatically increased tread life, safety, and fuel efficiency. The radial turned Michelin into a world leader and forever changed the tire and automobile industries. PAX was Michelin’s chance to do it again.

By traditional standards, Michelin executed brilliantly on a well-thought-out innovation strategy. Market research showed overwhelming customer support for the product’s value proposition, and Michelin had everything in place to succeed. The company had assembled a team of its best researchers, designers, and engineers and gave them top priority for resources and support. And the competition could not keep up. Not only were rival approaches to run-flat tires inferior to Michelin’s PAX System in terms of reliability, functionality, comfort, and safety, but the fortress of patents that Michelin had assembled around the system ensured that no competitor could enter the market with an imitative offer. Indeed, Michelin’s offer was so compelling that the company was able to co-opt its main rivals to support the PAX System as an industry standard.

But in the end, despite brilliant execution, the PAX story is one of failure. Because when your success depends on others, as it did for Michelin, execution is not enough.

Why Everything Looked So Right

Before we can understand why Michelin failed, we have to understand where it succeeded.

Seeing the Unmet Need

Michelin’s extensive market research showed that flat tires were both prevalent (60 percent of U.S. drivers had experienced a flat tire over a five-year period) and dangerous (in the U. S. alone nearly 250,000 automotive accidents per year were due to low tire pressure). If Michelin could eliminate the danger of underinflated tires and flats—both of which PAX did—it would represent a giant leap in consumer safety.

Michelin’s partners were also enthusiastic about the idea. Automakers liked the PAX System’s improved safety, which they could leverage as a key differentiator for new vehicles. But even more exciting were the new design possibilities run-flats offered. By eliminating the need for a bulky spare tire, Michelin’s system gave automakers the freedom to innovate for themselves by creating roomier car interiors.

Initial discussions with service garages suggested that they were also enthusiastic about the prospect of repairing run-flat tires. They could charge customers higher prices for repairing the tire, enjoying higher margins while maintaining service volumes (the PAX System would not reduce the number of punctured tires—it would only eliminate their danger and inconvenience).

Indeed, the PAX tires fit neatly into a modern timeline of strong safety features. Since the 1960s, vehicles had seen a steady of stream of breakthrough safety innovations—antilock brakes, traction control, crumple zones, and air bags—that first debuted on high-end vehicles and gradually became mainstream components. Michelin was positioning PAX System tires to be the next in line. CEO Édouard Michelin, great-grandson and namesake to the company’s nineteenth-century founder, was a champion of the PAX System: “We consider it a major development in vehicle safety, as important as the introduction of radials, if not more important.”

The PAX System was not the first attempt to tackle the problem of flat tires. Over the years, Goodyear, Bridgestone, and Michelin itself had all introduced self-supporting tires (SSTs) that incorporated reinforced sidewalls to support the weight of the car in the event of a flat. But SSTs had always suffered from significant drawbacks. The added weight of the reinforced sidewalls reduced fuel efficiency, and their rigidity led to a harsh, stiff ride. And the maximum range of punctured SSTs was only around fifty miles. As a result, SSTs’ share of the tire market was less than 1 percent. Clearly, there was plenty of room for improvement. The PAX System was a completely new approach.

Moving to Execution

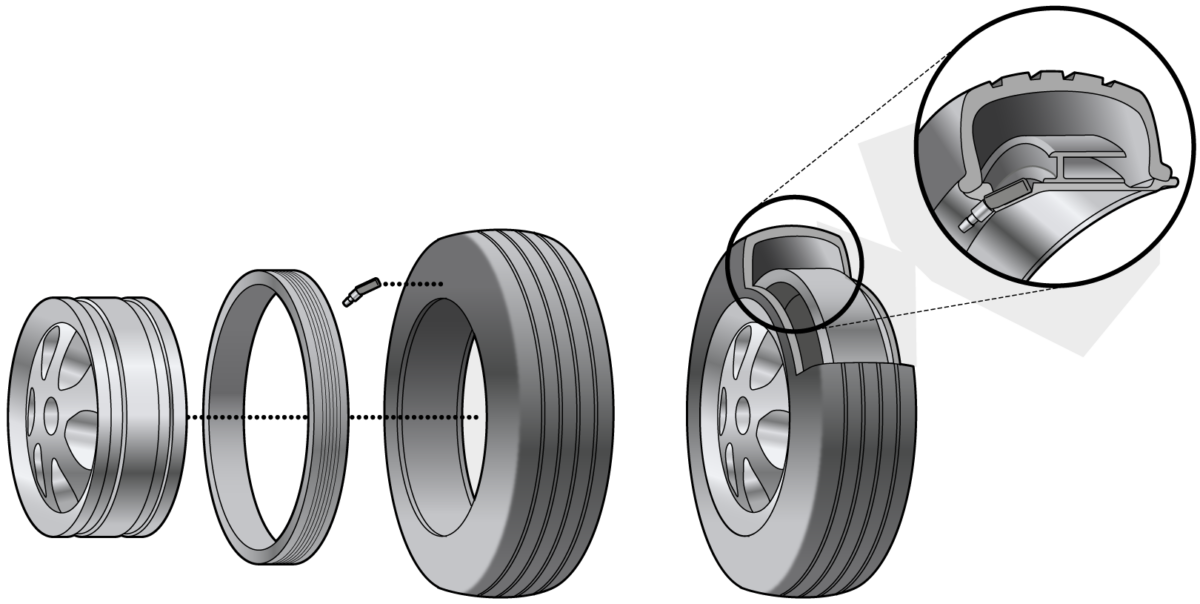

PAX System development started in earnest in early 1993. In contrast to the clunky SSTs, the PAX System’s unique architecture offered an elegant solution that sacrificed nothing in performance, nothing in weight, and provided twice the range of the existing alternative. Michelin’s engineers came up with a novel (and heavily patented) four-in-one combination of tire, support ring, alloy wheel, and tire pressure monitor.

Unlike traditional tires, which are held in place against the wheel by air pressure, in the PAX System the wheel was physically clamped onto the tire. Thus, in the event of a loss of air pressure, the tire would stay connected to the rim, riding on the inner support ring. The tire might look flat from the outside, but vehicle performance would be unaffected. Sitting in the driver’s seat, the motorist would not feel a difference.

The PAX System was a radical product change, but it required even more radical organizational changes within Michelin to become a reality. Traditionally, tire companies (like Michelin) made tires; rim manufacturers made metal wheels; and the two were assembled by the auto manufacturers. With the PAX System, Michelin had to oversee the design and production of an integrated system. The support ring, which would need to bear the weight of the car in the case of a flat, presented an enormous material science challenge. The wheels themselves needed to be asymmetric to allow for both the support ring and the necessary clamping mechanism. Finally, the tire pressure monitoring system, with its sensor, control unit, and alarm system, also needed to be developed. Michelin had to shift from product manufacturer to system integrator.

Michelin rose to the challenge. And despite confronting enormous technical challenges internally and among its partners, the company proudly launched the PAX System to the world in early 1998.

Soon after, Michelin took a second decisive step to secure the PAX System’s success. Carmakers insist on multiple suppliers for their components. Indeed, this had been a major hindrance to the adoption of radial tires fifty years earlier, and the PAX System would not be an exception. But in strategizing its rollout of PAX, Michelin proactively sought out, and found, partnerships with other tire makers to whom it eagerly licensed the technology. In June of 2000, after a year of secret negotiations, Michelin unveiled its masterstroke: an unprecedented alliance with Goodyear, the world’s second-largest tire maker.

“The two companies have decided to collaborate in a joint venture to develop leading-edge technology allowing vehicles to run on flat tires,” read the joint statement. “Today, PAX System has become a new standard. Goodyear and Michelin are convinced… that PAX System is the best platform for incorporation of future tire concepts into new vehicle designs.”

Between them, the two companies controlled almost 40 percent of the global tire market, and both expected the new alliance to open the door to widespread industry adoption.

Expecting Success (2001–07)

As 2001 began, widespread adoption of PAX System technology no longer seemed a question of if but when. J. D. Power & Associates performed its annual survey asking consumers what they put at the top of their priority list for automotive features: seven out of eight consumers chose run-flats.

The first company to sign on was Mercedes, which began equipping its ultra-high-end Class S armored cars with the tires. Cadillac soon announced it would start equipping select Corvette models. And in February, Renault, the French carmaker, launched the first production-line vehicle with PAX run-flats: the Renault Scenic. There were dozens of other development projects in the works with all the major automakers.

Discussing the benefits of PAX in 1999, Michelin CFO Eric Bourdais le Charbonniere remarked, “They perform better in every respect. In ten years, there won’t be any other kind of tire except PAX.”

Michelin moved quickly over the next two years. It struck additional deals with Audi and Rolls-Royce to stock run-flats on models in the United States, Australia, and Europe. And it added the fourth-and ninth-largest tire makers in the world, Sumitomo Rubber Industries and Toyo Tire & Rubber Company, to its PAX alliance. The new members provided a strong entry into Asia and opened up future deals with carmakers based there.

By the end of 2004, J. D. Power & Associates had come out with a new survey predicting that by 2010 more than 80 percent of cars would be fitted with run-flats.

In the United States, Honda announced that beginning in 2005 it would equip its best-selling Odyssey minivan with PAX tires. According to a Honda spokesperson, “The bottom-line benefit for the customers is the security of never being stuck on the side of the highway. That’s an important thing, especially for a minivan buyer who’s thinking a lot about safety and security.”

To ensure a successful launch, Michelin and Honda embarked on unprecedented coordination. Michelin boosted the standard PAX warranty to cover the first two years of driving or 50 percent of tread wear and began training and certifying Honda dealers and tire dealerships with PAX across the country.

In the rush to market, however, many of the Honda dealers were not ready when the Odyssey was launched. Michelin was aware of the problem. “As more vehicles take to the road with the PAX System, the traditional service and repair networks will continue to grow with them,” assured Michelin vice president of marketing Tom Chubb. As we will see, this was little comfort to Odyssey owners with PAX tires.

Confronting Failure

Despite a worldwide alliance of the leading tire manufacturers, and incorporation into popular car models, problems surrounding PAX were mounting, and eroding carmakers’ initial enthusiasm. Most pressing among these was growing consumer frustration with the difficulty of finding service centers that could repair the tires. Unable to repair flats, many drivers were forced instead to purchase brand-new tires, often in pairs so as to maintain their vehicles’ balance and alignment. At around $300 per tire, the runflat value proposition was rapidly eroding. Avoiding the danger and inconvenience of a punctured tire was a great proposition when the driver only had to pay a moderate premium for repair, but it was far less compelling when it required the driver to pay hundreds of dollars to replace the entire tire assembly.

In the United States, several class-action lawsuits were filed alleging that Michelin, Honda, and Nissan had “never disclosed that neither they nor any third parties maintained sufficient repair or replacement facilities (or the necessary equipment to perform such repair or replacement).” In November 2007, Michelin formally announced an end to further development of PAX. “Today we do not intend to develop a new PAX simply because there is no big market demand,” it said in a statement. “The market demand is insufficient to justify the expense.”

What had started as an “inevitable success” ended as a massive corporate write-down. But what makes this case so interesting is that the failure of PAX was not rooted in a misunderstanding of customer needs, in a competence shortfall that led to an inadequate tire, or a loss to a more able competitor. Rather, the failure was due to the inability to deliver the promised value proposition because of an unseen—but fully predictable—problem with the service network.

Michelin’s Blind Spot

If the PAX run-flat tire had been a stand-alone tire innovation, its success would have been largely assured by 2001. Historically, tire innovations live or die depending on end-user response. But with the PAX System, end-user acceptance was just one of the necessary conditions for success. The PAX System failed precisely because it was not a stand-alone innovation. For it to succeed, other members of Michelin’s innovation ecosystem—the car manufacturers and, crucially, the service stations—would need to buy into the system as well. Indeed, end users would be able to assess the attractiveness of the full run-flat value proposition only after the rest of the ecosystem embraced the new tire.

Commenting on the slow takeoff of PAX, Michelin director of technical marketing Don Baldwin explained, “This is not unlike the transition to radial from bias years and years ago. That was a relatively slow process, too. The market will determine that. We believe the PAX System will be the standard of the future.” But the very structure of the PAX ecosystem dictates its transition would be entirely unlike the radial transition. It is here that Michelin’s blind spot becomes apparent: to succeed, PAX would require a fundamental transformation in the tire ecosystem.

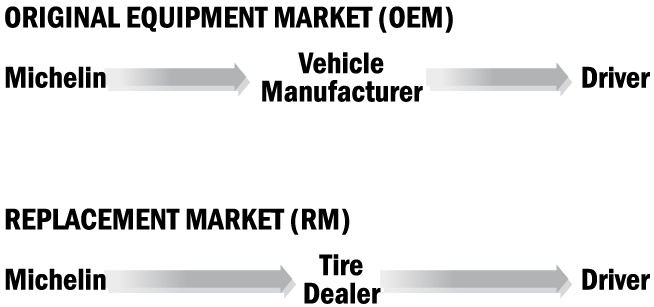

Tires are sold into two main segments: the replacement market (RM), which makes up three-quarters of industry unit sales, and the original equipment manufacturer (OEM) market, which accounts for the other one-quarter. Tire makers focus huge efforts on winning OEM contracts because they are a strong predictor of RM sales, since most consumers simply replace their old tires with the kind they originally had.

While automaker support provides a boost for new tires, tire makers can also reach consumers directly through the replacement market. Most tire innovations, like the radial tire, succeeded in the replacement market first and were only later able to penetrate the OEM market. Aquatred tires, for example, started as, and remain, a hugely successful replacement market product (see figure 1. 2). The SST approach to run-flats, which the PAX System was supposed to dominate (and which the industry continues to pursue) also followed this same traditional path to market.

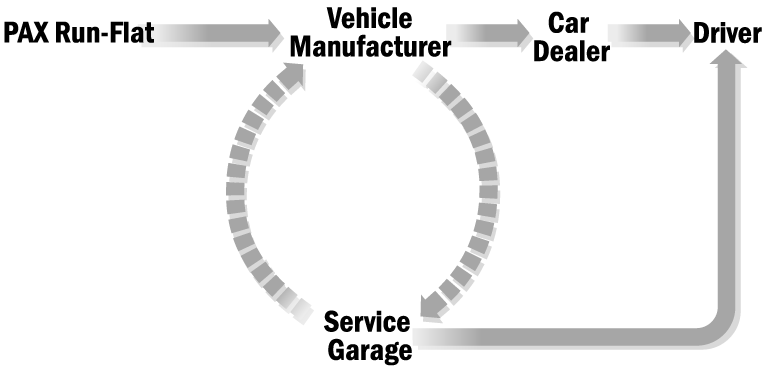

The very nature of the PAX System, however, required a different path to market, one which would add new actors and new interactions to the system (see figure 1.3). First, it required automakers to provide a very different level of support than was necessary for traditional new tires. Because of their asymmetric wheels and tire pressure monitoring systems, PAX had to start in the OEM market, as a designed-in feature of a new car. As such, there was no possibility of building initial support in the replacement market. Indeed, in order for run-flats to deliver on their full value proposition, such as by allowing for extra interior space through the elimination of the spare tire, they would need to be included as part of a vehicle’s design, long before it was even produced. And since the design-to-production cycle for cars can be well over thirty-six months, this meant that carmakers would have to decide to adopt Michelin’s innovation years before consumers would even have a chance to decide whether PAX tires were an attractive option.

Second, it required new car dealers to enter the picture. When carmakers introduce brand-new systems for their cars (think airconditioning, antilock brakes, power windows and steering, sound system, GPS), they tend to offer them first as optional features, for which buyers pay extra, and only later include them as part of the standard car package. If a feature is part of the standard package, selling the product to customers is easy because all that is needed is carmaker support. But when it becomes an option, a new player is added to the mix: the salesperson at the new car dealership. Now, sales also depend on whether the salesperson is incentivized to guide customers to buy the PAX package for their new car versus, say, a GPS or satellite radio package. And while Michelin had deep experience in dealing with automakers and tire dealers, their relationship with new car dealers was much less established.

Finally, and most critically, PAX required service garages to enter the picture in an entirely new way. For garages, repairing innovative tires had never required any major change to their activities, equipment, or capabilities. For this reason, they were never a factor in the success of new tire launches. But repairing a PAX tire was a different story: the garage needed completely new equipment to clamp and unclamp the tire to and from the wheel, new tools to calibrate the tire pressure monitoring system, and new training for its repair staff. What’s more, to ensure correct repairs, Michelin required technicians to undergo a rigorous certification process to be qualified to service the tire.

Although carmakers, auto dealers, and service garages have always played a role in the success or failure of tires, the very nature of the PAX proposition changed this dynamic. In the past, these players had served only a peripheral role, but with PAX they became core to delivering the value proposition. Thus, they would need to be managed in a very different way than ever before.

When the PAX System was developed, it created new interactions not only between Michelin and these players but also among them. For a carmaker, the attractiveness of installing run-flat tires on a car depends on how many garages are able to repair the tire in case of a flat. But the attractiveness for a service garage to install the repair equipment and train its personnel depends on how many cars on the road have PAX installed. Even as the PAX System became a standard on a handful of new car models, these cars were but a trickle into an ocean. It would take many years before they could possibly account for a meaningful percentage of cars on the road—and, for this reason, years before they could be meaningfully attractive for garages to service.

Figure 1.3 presents a very different picture of value creation than the one Michelin was used to managing. The contrast with figure 1.2 is striking: new actors are added, old actors eliminated; positions are shifted; and new links and relationships are created. We can see that, underlying the PAX value proposition, this was a complete reconfiguration of the tire ecosystem. And this means that the difference between the success and failure of PAX would hinge on Michelin’s ability to see and drive this reconfiguration.

Ecosystem reconfiguration is at the heart of every new value proposition that breaks from the existing industry mold. Keurig and Nespresso combining coffeemakers and single-serve capsules hinged on transforming their relationships with distributors; Caterpillar offering fleet management and remote monitoring and operation of its construction machines hinged on creating new interactions at construction sites; Marriott expanding from hotel rooms to travel packages hinged on the seamless integration of new partners: any organization that aspires to transition from stand-alone products to integrated solutions, from insulated projects to collaborative systems, is signing on to a transformation of this sort. For these strategies to succeed, it is no longer enough to manage your innovation. Now you must manage your innovation ecosystem.

For many companies, including Michelin, managing innovation ecosystems is problematic because the tools and systems they have honed over years of managing successful stand-alone innovations are ill suited to address the interdependence challenges that are inherent in the transition to ecosystems. This is the source of the innovation blind spot. And this is exactly what the wide-lens tools and principles introduced in this book will allow you to see and manage.

PAX Run-Flat Epilogue

I feel great sympathy for Michelin’s managers. They waged a valiant campaign to establish the PAX System as the new tire standard, trying to repeat the company’s success with the radial of fifty years earlier. But the structure of the PAX ecosystem was entirely different. Most critically, the PAX value proposition created an entirely new role for service garages—one that they were not eager to assume. Non-adoption by this critical partner was the key barrier to the PAX System’s success. The inability to service PAX tires led to consumer backlash and lawsuits that, in turn, reduced automakers’ enthusiasm for the system.

Simultaneously, the uniqueness of the PAX offer was being eroded by the spread of tire pressure monitoring systems (TPMSs). TPMS had been developed to work with the PAX System. But TPMS also worked with standard tires. Simply installing an air pressure monitor (standard on PAX tires but still uncommon in the 1990s) was expected to reduce blowouts and prevent as many as 79 deaths and 10,365 injuries each year in the United States alone. And although the standard installation of pressure monitoring did not negate the other unique features of the PAX System, it certainly stood to reduce the PAX System’s relative advantage. And this reduced everyone’s incentives to keep pursuing the PAX vision—automakers saw reduced potential to tout it as a safety-based differentiator, and garages saw even less reason to invest in specialized repair equipment. The window of opportunity had closed.

An Alternative Market

The bottleneck to success in the commercial market was not due to a lack of driver enthusiasm for the PAX value proposition; it was that garages kept the value proposition from being realized. Interestingly, a modified version of the PAX System has been an unqualified success in the one market where service stations do not play an independent role: the military. The U. S. Army’s fleet of Stryker armored vehicles, introduced into combat service in 2003, are equipped with run-flat tires.

Using a wide lens, we can see that the critical difference was not that flat tires in a war zone are a bigger worry than flat tires at rush hour (although they very clearly are). Rather, the key difference is the structure of dependence:

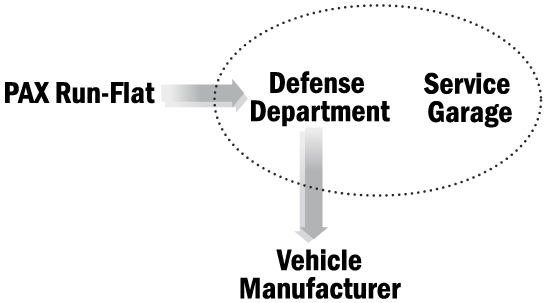

The structure of the military market (figure 1.4) favors the runflat’s success because there is no intermediary between the buyer (defense department) and Michelin. Instead, the order of events is that first the buyer agrees they want to adopt the system, and then it specifies the kinds of tires it wants on the military vehicles (unlike in the consumer market where the cars are designed for the buyer). And, critically, since the military runs its own garages, the buyer takes care of the service role themselves. Using the widelens terminology, in the military market there was much lower adoption chain risk since the customer agrees first, and then the rest of the system follows suit.

As of 2010, over 3,500 Strykers have been built and played prominent roles in the campaigns in Iraq and Afghanistan. As the flagship light armored vehicle for the U. S. military, more are on the way. Unfortunately, the military market alone is not enough to make PAX a success—not because it isn’t profitable, but because Michelin’s initial expectations were to revolutionize all vehicles on the road, not just the small niche of military transport vehicles. As it is, Michelin’s fifteen-year PAX odyssey left them with little but a costly, though valuable, lesson.

Is There a Better Way?

It is always easy to critique failure after the fact, but it is not always fair. An unfair critique focuses on the failure and criticizes management for the outcome. It focuses on the specific choices made. A fair critique focuses on the way that choices were made. It offers an approach that could have reasonably been used to arrive at defensible recommendations before the outcomes were known.

The failure of PAX was such a surprising defeat because, from a traditional perspective, Michelin did everything right. The company’s mistake was its failure to understand the innovation ecosystem on which its success depended.

In the end, Michelin’s failure was rooted in its inability to bring enough service stations on board with the PAX System. But in the beginning, Michelin treated service stations as a low priority. The reason, of course, was history. Historically, service station support could be assumed, but in the run-flat world that Michelin constructed, service stations held the keys. And because Michelin underestimated their role, it underinvested in managing this critical dependence. This was not as much a problem of funding as it was a problem of strategy. When Michelin took the major step of redesigning the entire wheel, the company took on a whole new role without realizing it.

We have been taught the consumer is the final arbiter of value. But the consumer is not the only arbiter of value. Often, a host of other partners stand between the innovator and the end consumer, such as the suppliers who need to ship components to your factory, the distributors who navigate your product through the retail channel, and the retail outlets where the end consumer finally decides whether or not to purchase your offer. These partners customize activities for every product launch—new procurement arrangements, new manufacturing, new marketing support, etc. But the ways in which these activities are organized, and the ways in which different partners interact with one another, tend to follow a well-established set of routines. As long as your innovation fits within their routines, these partners remain invisible and your success is determined on a stand-alone basis. But when your innovation depends on these partners to change their routines—as Michelin’s PAX System did—they become a critical, but easy to overlook, determinant of your success.

The principles and tools that I will explore in the coming chapters will help ensure that you will not fall into this trap.

Throughout this book, our approach will be to assess the value proposition of every new innovation according to the three risks of innovation:

- Execution risk: The challenges you face in bringing about your innovation to the required specifications, within the required time.

- Co-innovation Risk: The extent to which the successful commercialization of your innovation depends on the successful commercialization of other innovations.

- Adoption Chain Risk: The extent to which partners will need to adopt your innovation before end consumers have a chance to assess the full value proposition.

Each of these risks is governed by a different logic. And as we saw in the Michelin saga, success requires that each risk be addressed. Michelin managed its own execution challenges well. It was also successful in navigating its partners’ co-innovation challenges (rim manufacturers responsible for developing the new clamping architecture; component suppliers responsible for developing the TPMS solution). Its failure was rooted in mismanaging the adoption risk posed by the hidden assumption in its strategy: that garages would invest in PAX repair equipment in advance of PAX’s mass-market adoption.

The traditional tools of strategy, marketing, operations, and project management offer excellent guidance for seeing and managing execution risk, and so I will not focus on those here. These are necessary, but not sufficient, conditions for success. In this book, I will take great ideas and great execution as the starting point and focus on the requirements for success that lie beyond your own initiative. This book is about seeing interaction between your own execution risk and the risks that are introduced by your ecosystem partners. It is about how to revisit your strategy to proactively manage these interactions and, in this way, drive better outcomes.

Co-innovation risk and adoption chain risk lurk in the blind spot of traditional strategy. They remain dormant as long as your innovations follow established lines. But when you try to break out of the mold of incremental innovation, ecosystem challenges are likely to arise. This is not a problem if you are prepared. It can be devastating if you are not. Just like the blind spot when you are changing driving lanes, not seeing the other car coming doesn’t make the accident any less awful. The same is true with strategy: a strategy that does not properly account for the external dependencies on which its success hinges does not make those dependencies disappear. It just means that you will not see them until it is too late.

In order to avoid these accidents, you need to adopt a structured approach to innovating in ecosystems, a new set of guiding questions to ask when your own efforts no longer determine your success. The following chapters will give you that approach. They will expand your focus beyond the usual (and correct) obsession with customers, capabilities, and competition. They will give you a perspective that will help reveal the dependencies that hide beneath the surface, avoid the predictable disasters, and choose and manage initiatives in a smarter and more effective way.